Polymer Price Know-How: October 2023

The leading polymer distributor, Plastribution, released the October Price Know-How instalment. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month sees the launch of the Sustainable Polymers section after Plastribution saw a need to expand the monthly market report to give guidance on a variety of different sustainable material types.

Overview: October 2023

The direction of polymer pricing continues to look uncertain.

As polymer producers continue to try to push through inflationary cost increases the supply/demand balance for polymers continues to create resistance and this is combined with concerns that downstream demand will remain weak.

The inflationary pressures that polymer producers face continue to increase with crude oil price increases causing hikes in monomer prices, and the crude oil cost increases are exasperated by recent strength in the USD, which has gained about 2.5% in value against both the GBP and the Euro in recent weeks. USD strength will also impact on the price of polymers which are USD denominated, including engineering polymers and high performance styrenic polymers such as ABS, this effect will also likely be felt in HDPE and LLDPE markets where US origin material is taking an increasing share of UK and European consumption.

Despite some more positive trends in terms of the UK macro-economic data, converters remain downbeat, citing plentiful supply and supressed downstream demand as justification for a dislocation between feedstock and exchange rate inflation and polymer pricing. In addition, converters appear to be quite well stocked and on this basis are adopting a ‘wait and see’ purchasing strategy, hoping that they can stretch the situation out until low seasonal demand at the end of the year causes polymer suppliers to concentrate on moving volumes through the supply chain.

Current expectations are that price increases will be applied in November across PE and PP grades, with then a review at the end of the month before determining price action in November. Unless there is a substantial improvement in demand then there is already expectation of a soft rollover.

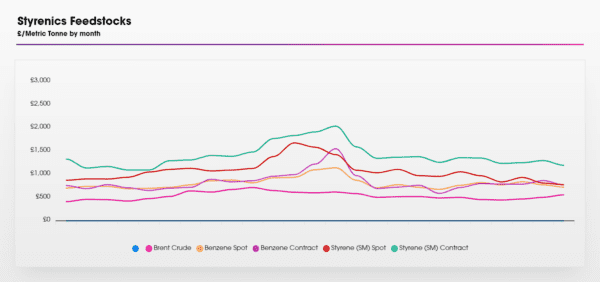

In the case of polystyrene, the volatility of Benzene and SM continue to be reflected in prices and triple digit increases are widely being applied in October.

Whilst demand remains weak for most engineering polymers, there is growing consensus that prices have at least reached the bottom.

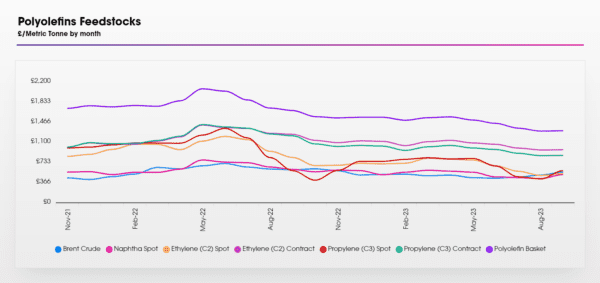

Polyolefins

Prices continued their rise in October with most polymers following the monomer increases. Ethylene C2 rose by €65 / MT and Propylene C3 rose by €60. Whilst most Producers appear to be going with monomer increases, some are targeting slightly more due to individual shortages of certain products. LDPE appears to be one of the tighter grades and does appear to be seeing stronger increases than most. PE is fairing slightly better than PP with many key markets for PP such as Construction and Automotive continuing to face economic headwinds.

With PE, we continue to see the effects of reduced imports from the Middle East and USA as the pricing in Europe has been unattractive. Whilst our pricing has improved, we won’t feel the effects for another month or so, expect to see some tightness in key import grades of LLDPE and HDPE. LDPE is not so reliant on imports, but we saw many European producers trying to reduce stocks in the summer and we now see the effects with shortages widely reported.

PP is still struggling with a Supply and Demand imbalance. Whilst the monomer increases are being pushed through as it’s not possible to avoid it given the current economics of producing PP in Europe, any attempts are recovering margin are being rebuffed. Buyers of PP are in a relatively strong position to negotiate and are pushing back at attempts to secure increases above monomer.

Outlook beyond October is unclear. Supply and Demand remain important to the pricing of Polyolefins, but the cost position is very variable. Oil prices were dropping in early October but started to rise again with global uncertainty over conflict in the Middle East and some suggestions of a rise in Chinese demand.

Styrenics

Engineering Polymers

Sustainable Polymers

As the industry pivots further towards eco-conscious practices, Plastribution saw a need to expand its monthly market report to give guidance on a variety of different sustainable material types.

Ian Chisnall, Product Manager for Sustainable Polymers, will start with some basics on recycled materials. As more market data develops on other sustainable polymers, such as bio-polymers and other renewable feedstock grades, Plastribution look forward to expanding this section to make it even more comprehensive, so please subscribe if you haven’t already to keep up to date with the latest developments as they come!

Recycled LDPE / LLDPE

Recycled LDPE / LLDPE has risen roughly in line with prime grades. With prime LDPE rising strongly in price and with some supply issues, buyers have turned to recycled grades more to fill the gaps.

Whilst some sales of recycled PE are driven by a need to comply with legislation on packaging tax, others are looking for a cost reduction over prime. Those looking for higher quality recycled grades with tight specifications, can expect to pay prices like, or higher than, prime LDPE.

Recycled HDPE

Recycled HDPE has also moved in line with prime material. Broad range of pricing continues to be seen with “natural” blow moulding grades suitable for personal care packaging for high street brands continue to command strong premiums over prime grades.

Black, jazz and broad specification grades for pipe etc. are still below prime prices.

Recycled PP

Recycled PP has also risen in price but is perhaps not pushing through as strong an increase as PE as demand from key sectors such as Automotive continues to be weak. Spot deals are reported at increases below the monomers seen in prime pricing.

High quality filled compounds with tightly defined specification for more demanding applications still have a premium over prime grades. Price vary depending on specification. Grades that can be overcoloured are typically priced around the same level as prime with natural grades, like HDPE, able to command a significant premium over prime.

Price Know-How: October 2023 Full Report

Visit the Price Know-How website to read the October 2023 update, including an in-depth analysis of each market segment and material group by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How is an industry-leading report to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at the leading polymer distributor, Plastribution, with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions, so you don’t need to!

To subscribe for free and receive monthly updates directly to your inbox please click here.

Plastribution

+44 (0) 1530 560560