Plastribution’s Polymer Price Know-How: July 2024

|

Getting your Trinity Audio player ready...

|

Plastribution’s July Polymer Price Know-How reports that inflationary price pressures continue to mount, yet converters are becoming more proactive, rushing to secure additional volumes at June price levels. Despite the challenges posed by high shipping costs and port congestion, there is cautious optimism among sellers about potential price increases. The impact of reduced production output and supply chain disruptions, coupled with the start of the summer holiday season, is being closely monitored across the European and UK markets, where demand typically fluctuates.

Are markets about to tighten, as the economics of imports from other regions look increasingly unfavourable?

It is pretty much the case of the same story; different month as the inflationary price pressures described in the June edition of Price Know-how continue to build. However, the sense of ambivalence coming from converters is starting to diminish and a recent flurry in attempts to secure additional volumes at June price levels is giving sellers increasing confidence that prices are about to move forward. As expected, some converters point to slack demand in Western Europe, as the summer holiday season gets underway, putting sellers under pressure as demand typically falls away.

Others are taking the view that what has been a sustained increase in shipping costs due to issues including vessel capacity, container availability, port congestion and higher costs still resulting from diverting shipping routes around the Cape of Good Hope to avoid the issues affecting the Red Sea, as being likely to diminish as China starts to throttle back its exports.

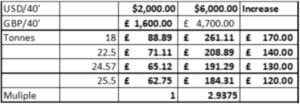

Taking the most recent publication of Drewry World Container Index weekly weighted freight rate assessment of eight major east-west trades, the overall jump of some $4,000 per 40’ container, since the start of the year, equates to the following table of cost increases per tonne based upon current exchange rates:

Even taking the best case of loading 25.5 tonnes into a 40’ shipping container, the £120 increase in shipping cost per tonne will be prohibitive for standard polymers, and the majority of engineering polymers that originate from the Far-East.

Polymer production in many regions of the world is now a lossmaking activity, often not even covering variable costs, and hence more and more producers are taking the decision to idle production. Reducing output will restrict availability and this will help to rebalance supply and demand.

It is going to be interesting to observe price action over the summer months, and converters with limited inventory are most likely to experience price increases.

Monomer Price Movement

Exchange Rates

€- 1.18

$- 1.27

€/$- 1.08

Polyolefins

Although both monomers Ethylene C2 and Propylene C3 rolled over, Polyolefin prices are starting to rise in July on the back of restricted availability. The global shipping issues are worsening with port congestion and rising freight rates as ships avoid the Suez Canal. Containers from Southeast Asia to Europe are now hitting $10,000 adding £200-300 / MT to the delivered cost of polymer. European production is being kept at low run rates to try and balance supply and demand. Some plants are still in Force Majeure with technical upsets and industrial action.

Some producers are already implementing order stops and more are predicted with further increases in August expected. Whilst demand remains muted buyers are likely to have to pay the higher prices to secure the limited supplies. Hurricane Beryl is impacting production of most PE and PP grades and is likely to limit exports from the USA to Europe.

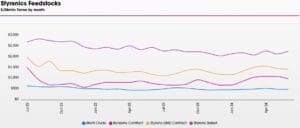

Styrenics

Contract EU Styrene slumps, EU polymer prices follow, but Far East imports rise with shipping increases.

Styrene Monomer has suffered a steep drop, settling at €1542/T, a decrease of €138/T from June.

For July, EU GPPS, HIPS and ABS has fallen. Deep sea materials have increased due to rising shipping costs, and all FR materials are increasing due to steep rises in Antimony Trioxide notations, attributed to increased demand in China for Solar Panel production.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

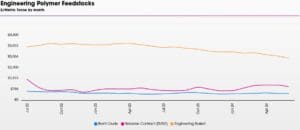

Engineering Polymers

Demand remains relatively weak and supply is more than adequate for most engineering materials. The July benzene contract settled €162/mt lower at €990/mt, which means that most prices will come under further downwards pressure going into the new quarter and the traditional holiday period. The only exception is PMMA, where the ongoing shortage of MMA means that prices will increase.

Sustainable Polymers

Recycled materials have seen slight increases in July. Some converters are turning to recycled as prime grades are increasing in price and availability is limited. We also see some signs of increased demand from brands for more Sustainable options pushing up prices for the higher quality materials suitable for packaging of FMCGs.

Recycled LDPE / LLDPE

LDPE / LLDPE has increased in July with some recyclers pushing through €50 / MT as they have very limited availability and stronger demand.

Recycled HDPE

HDPE is also seeing stronger demand, particularly in the higher quality grades for consumer packaging. Natural blow moulding grades continue to command a very significant premium over prime. Lower quality grades are also doing OK with signs of increased demand in non-critical construction applications.

Recycled PP

Recycled PP is also seeing stronger demand, particularly in the higher quality grades for consumer packaging. Natural blow moulding grades continue to command a very significant premium over prime. Lower quality grades are also doing OK with signs of increased demand in non-critical construction applications.

Price Know-How: July 2024 Full Report

Visit the Price Know-How website to read the July 2024 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.

+44 (0) 1530 560560

Website

Email