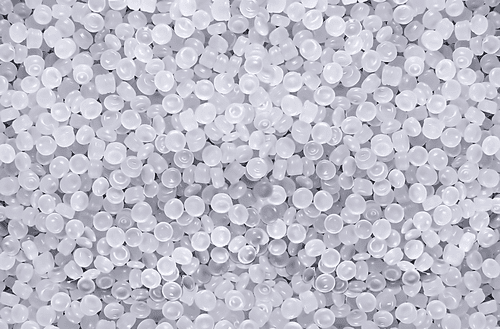

Polymer Price Reports Released for July 2018

The latest polymer price reports and charts have been released by Plastrack.

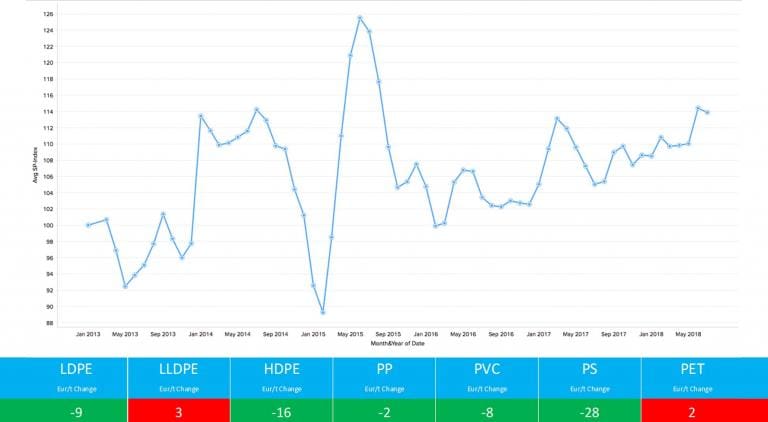

Standard Thermoplastics Trends July 2018:

Ethylene (C2) Feedstock – in July prices were stable. The continuing high temperatures across Europe are causing production issues with lower levels of supply preventing any prospect of price depression set against the lower levels of demand due to the holiday period.

Propylene (C3) – in July prices were stable with lower production output being seen which has been attributed to the continuing high temperatures in Europe. Demand was low due to the holiday period.

LDPE, LLDPE, HDPE small price reductions trickled through in July as a result of lower demand and normal levels of supply. August is expected to be stable with little market change from a demand, supply or price perspective.

PP pricing and conditions were stable during July with the market being well balanced from a demand and supply perspective. This has provided some welcome respite from the past few months of price increases.

PVC pricing levels reduced by around Eur 8/mt in the month as weaker demand was balanced against a continuing high supply situation.

Styrenic prices experienced a Eur 28/mt reduction in the month as the lower levels of demand caused by the summer holiday period are set against normal levels of supply. The recent price falls in styrene monomer are being passed down the chain by producers. Pricing is expected to increase in August as a result of a slight pickup in the styrene monomer price seen in early August.

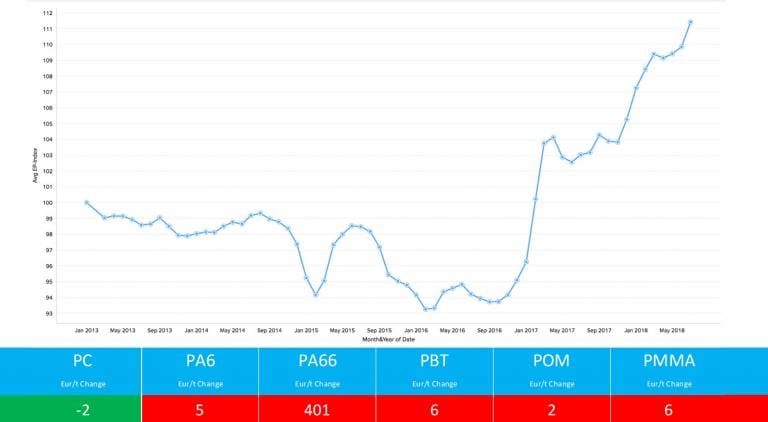

Engineering Thermoplastics Trends July 2018:

Benzene feedstock pricing increased by Eur 29/mt in the month. The market moved very much to an oversupply situation towards the end of July with low demand and normal levels of supply. Predictions are for a price fall in August as demand is expected to continue at a lower level during the remainder of the summer.

PC price was stable in the month. Lower levels of demand was better balanced against the low levels of supply preventing any pricing change. August conditions are expected to mirror July.

PA6 pricing was stable in the month. The market appears a little tighter in the month due to lower levels of supply (traditional summer production outages) with normal levels of demand.

PA66 pricing experienced a record Eur 401/mt movement in the month caused by further serious force majeure (this time in the USA). Demand was at a high level and their doesn’t appear to be an end in sight with little change to market conditions expected in August.

PBT pricing was stable in the period with lower levels of demand and normal levels of supply.

POM pricing was stable in the month with lower levels of demand balancing better against the low levels of supply.

PMMA pricing was stable in the month lower levels of supply prevented the price reductions that many had hoped would be seen. Buyers continue to push for discounts and it remains to be seen if producers begin to reduce pricing.

Plastrack Polymer Price Index

Plastrack is a web based tool which can be accessed by desktop, tablet or mobile and provides pricing data on the most common feedstocks and polymers. Prices are updated on a monthly basis based on information obtained by Plastrack researchers directly from plastics producers, traders, distributors and converters. Visit Plastrack’s website for more information.