Polymer Price Reports Released for August 2019

The latest polymer price reports and charts have been released by Plastrack.

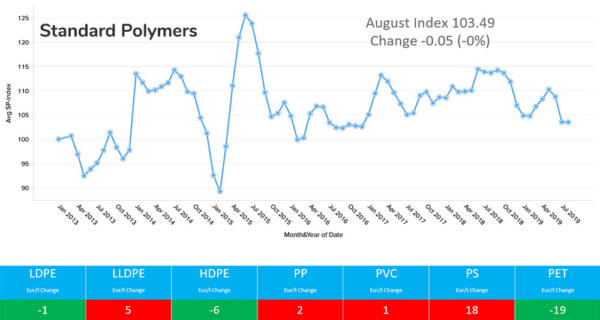

Standard Thermoplastics Trends August 2019:

Ethylene (C2) Feedstock – in August prices reduced by Eur 38/mt on the back of lower naphtha costs. Demand is at lower levels with maintenance stoppages; however this did not cause upward price pressure as demand is at low levels.

Propylene (C3) – In August prices reduced by Eur 48/mt reflecting the lower naphtha costs seen in the market in recent weeks. Supply and demand are balanced but at lower than normal levels.

LDPE, LLDPE, HDPE – prices were largely stable in the period, and the small increases in ethylene reference prices were not able to be passed through to end markets. Supply is at high levels with significant stocks building in the supply chain against the backdrop of lower levels of demand. Further price reductions are predicted in the coming period.

PP pricing was largely stable in the period. Weak demand is set against normal supply volumes; this will no doubt lead to a weakening of the reference price in the coming period.

PVC pricing was Eurozone stable in the period. Supply was at normal levels despite maintenance outages, and demand continued at lower levels due to the summer holiday period. Price reductions are expected in the coming period on the back of falling ethylene reference prices.

Styrenic prices increased by Eur 18/mt in the period driven by increasing price levels of styrene monomer. Supply and demand are at lower levels.

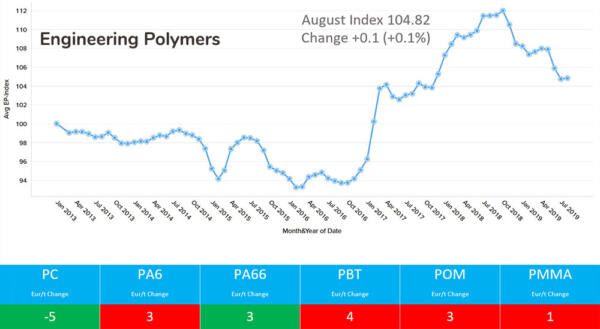

Engineering Thermoplastics Trends August 2019:

Benzene feedstock pricing increased by Eur 90/mt in the month of August. The market is balanced, but at low demand and supply levels.

PC prices were largely stable in the period with small reductions of Eur 5/mt seen in the market. The market continues to be oversupplied, and demand is at lower levels with the continuing weak performance of the automotive sector. Price reductions are expected in the coming period on the back of high stock levels building in the market.

PA6 pricing was stable in the period. Stock levels are building in the market with high levels of supply. Demand continues at lower levels. Forward pricing is anticipated to be stable.

PA66 pricing was stable in the period following the fall of Eur 46/mt in the prior month. The weaker demand from the automotive market set against high levels of supply (large stocks in the supply chain) should facilitate price reductions in the coming period.

PBT pricing was largely stable in the month of August. Supply is at normal levels; however, demand was low owing to the summer vacation period across the Euro zone. Price stability is expected in the coming period

POM pricing was largely stable in the month of August. Supply is at normal levels; however, demand was low owing to the summer vacation period across the Eurozone. Price stability is expected in the coming period

PMMA pricing was stable in the period. Supply is at high levels with demand continuing to below. The build-up of stocks in the supply chain are expected to provide downward price pressure for producers.

Plastrack Polymer Price Index

Plastrack is a web-based tool which can be accessed by desktop, tablet, or mobile and provides pricing data on the most common feedstocks and polymers. Prices are updated on a monthly basis based on information obtained by Plastrack researchers directly from plastics producers, traders, distributors, and converters. Visit Plastrack’s website for more information.