Polymer Price Know-How: November 2023

Plastribution, the leading polymer distributor, has unveiled their November Price Know-How update. Price Know-How remains a valuable resource for plastic raw material buyers, aiding them in making well-informed purchasing choices. Efforts to raise polymer prices in 2023 faced resistance as converters depleted existing inventories to avoid higher costs. Weak demand upstream and downstream led to widespread declines in contract monomer prices, potentially signalling a 2024 recession risk.

Overview: November 2023

Weak demand in October puts downward pressure on polymer prices.

The attempts by polymer producers to push volume polymer prices forward in the second half of 2023 appear to have been thwarted. Not only did polymer converters consume existing inventories to resist buying higher-priced material, but both upstream and downstream demand was fundamentally weak.

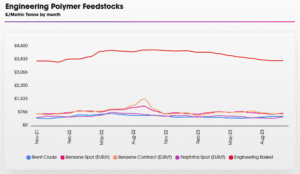

The upstream weakness is reflected in the across-the-board fall in contract monomer prices, which sharply contrasts with relatively stable crude oil prices. Again, the discount for spot over contract monomer costs is significant and the principal cause of contract price reductions. The UK and European markets ‘ weakness in downstream markets is evidenced, suggesting a considerable risk of recession in 2024.

Most players remain confused by the lack of demand from converters, with questions about substitution, supply chain destocking, fundamental shifts in consumer behaviour, and increased polymer production remaining unanswered.

Engineering polymers’ situation remains unchanged, with suppliers still seeking to win market share through price competition.

Polyolefins

After gaining ground in recent months, polyolefin prices fell back in November following the drops in monomers. Ethylene C2 dropped by €45 / MT, and Propylene C3 dropped by €40. At the start of the month, some initial attempts were to limit reductions to a very optimistic rollover or a €20 / reduction. Still, within a week, most market players had to concede and pass through the complete monomer reduction.

PE and PP markets have seen a switch in fortunes this month, with PE now appearing to be longer in supply and weakening in demand, with PP showing more signs of a recovery in demand and availability being hit with a few minor issues.

With PE, after some tightness in September and October, there don’t appear to be any challenges in securing material to meet requirements. Imports are improving on the back of improving European pricing in recent months and low demand in the rest of the world. More shipments from the USA and the Middle East are arriving, and more are coming for delivery in December and early 2024. With no expected interruptions to supply, most buyers are operating hand to mouth as further slight reductions are anticipated in December depending on the oil price and consequent downstream movement of monomers.

PP has stabilised a little after some months of volatility. PP Copolymer has seen a few shortages this month for specific grades as a handful of European plants experience unexpected interruptions. Propylene monomer has a few supply glitches at the start of the month, but that appears to be resolved and should have no significant impact.

Outlook beyond November is for a slight decline in December depending on monomers and a hope, perhaps not quite an expectation, from producers that this will be recovered in January. Some think that without a boost to economies to drive demand, the oversupply situation in both PE and PP Globally will continue to depress pricing and the aspirations of producers to restore margins to the black.

Styrenics

Contract Styrene Monomer Falls

Styrene Monomer has dropped, settling at €1486/T, a decrease of €149/T from a high point of €1635/T in October. The main driver was a €148/T fall in Benzene and increased supply.

SM supply has improved as the long-awaited US imports arrive, and an EU plant has restarted.

For November, EU GPPS and HIPS have decreased by €120T, and EU ABS will reduce also.

GPPS/HIPS/ABS supply chains are running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors are running inventory at very low levels due to financial pressures. Therefore, the adjustment in SM/PS prices is likely to be passed on immediately.

It is to be noted that the shift in EU styrene monomer is unlikely to have a significant effect on Styrenic materials imported from the Far East, where prices have remained flat for the last few months.

Engineering Polymers

There is no significant change to the market, with automotive, E&E, and construction all remaining quiet, and little change is expected as we start the rundown to the Christmas period. There are early signs of price increases on some raw materials, specifically for PA6, with increasing costs for caprolactam, however, with a stagnant market and plentiful inventories, it will prove not easy to push through any increases.

The benzene contract settled €148/mt lower than in October.

Sustainable Polymers

Most recycled materials have fallen in line with the changes in prime grades this month as demand continues to be weak and supply is decent. Whilst there are few spots of tightness in the market for higher quality grades, converters are only buying their minimum requirements as we near the end of the year.

Recycled LDPE / LLDPE

LDPE / LLDPE has dropped roughly in line with monomer but with some reports that transparent and translucent grades hold prices better than black and jazz.

Recycled HDPE

Recycled HDPE has also moved in line with prime material. Natural grades continue to command substantial premiums above prime for specific applications such as household goods packaging.

At the other end of the scale are reports of deals to move stock of “regran” for low-value applications.

Recycled PP

Recycled PP has seen some slippage in pricing that reflects the movement in prime, but some grades in niche applications are holding on to prices better.

The Automotive sector is showing some signs of recovery, and this is a key growth area for recycled PP. Some spot deals for general-purpose grades with a broader specification are reported in the market.

Entirely natural recycled PP continues to be sold well above prime pricing.

Price Know-How: November 2023 Full Report

Visit the Price Know-How website to read the November 2023 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

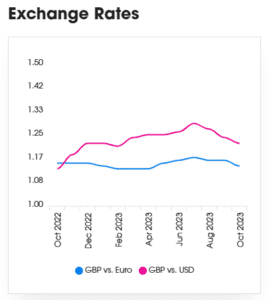

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. We do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

+44 (0) 1530 560560

Website

Email

Read More on Plastribution Here | PlastikMedia