Polymer Price Know-How: November 2022

- Becca Watt

- November 22, 2022

- 7 minutes read

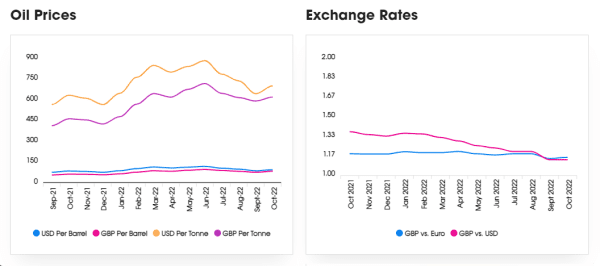

The latest instalment of Price Know-How has been released by the leading polymer distributor, Plastribution. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month, feedstock producers have achieved price increases across the board, halting what has been a strong downtrend since July.

Overview : November 2022

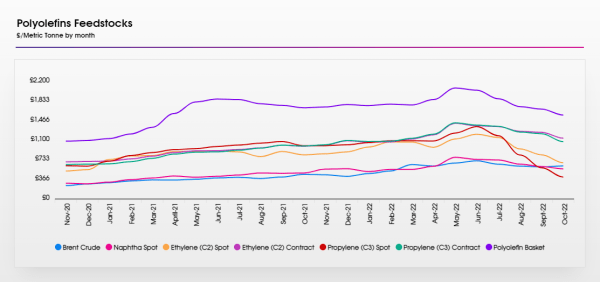

Despite a public holiday at the beginning of November in continental Europe, delays in the settling of C2 and especially of C3 contract rates on the 4th of November gives some indication of hard-fought negotiations. More moderate increases on C3 is still reflective of the greater abundance of propylene and the relatively low spot price for this commodity.

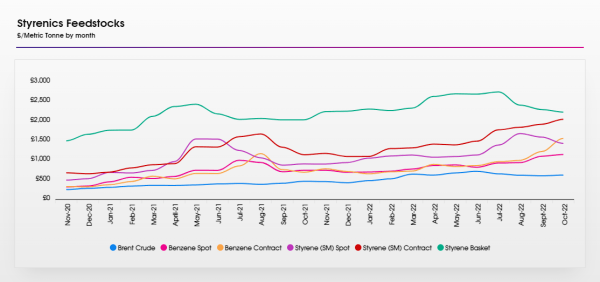

Perhaps the more important issue relates to polymer pricing. Based upon feedstock cost increases, already hard-pressed polymer producers in Europe will be unwilling to make further concessions on price and instead will be looking to increase prices in order to move back towards profitability. Whilst these may end up as noble ambitions, it really does look like prices are now at the bottom and sooner or later the next move will be upward.

December price increases are an exception. It is possible that buying activity, combined with lower inventory levels will kick-off a price inflation spiral. It is also clear that ‘special offers’ have disappeared from the market. Even if prices are not increasing, there is a strong feeling of price consolidation which typically precedes an upward movement in the market.

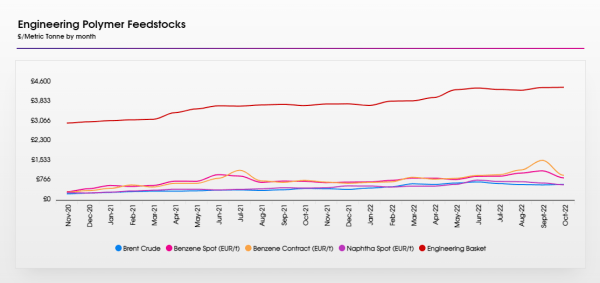

In the case of engineering polymers and higher value styrenic polymers such as ABS, it is now apparent that lack of demand in Asia, especially China, is stimulating deep-sea exports to Europe and pricing is becoming increasingly competitive. The greater reliance that this group of materials has on global economic conditions will override the pressure of input cost increases. On this basis, it looks like pricing may now have peaked.

Polyolefins

November has seen some stability in the market following the price rebound in October. Monomers both rose, with C3 Propylene increasing €20 / MT and C2 Ethylene up €35 / MT. Whilst some producers sought increases on the back of these feedstock movements, most eventually retreated to rollover as demand remained muted. Some are still seeking monomer increases on LDPE citing individual shortages.

Others reliant on deep sea imports from either Middle East or USA have held their ground on increases for LLDPE, with reports of delays on shipments. Energy surcharge discussions have been quieter this month and it remains to be seen if the promised push for increases in this area goes forward. With no significant supply interruptions and market interest low in the face of global economic factors, it’s a buyers’ market and producers may not be able to force through surcharges.

Outlook for December is expected to be very similar but with many companies proposing early shutdowns, demand could weaken further. No significant movement in monomers is expected for December so a likely scenario is rollover in polymer prices. Producers are cutting production or extended planned shutdowns to try and balance supply and demand.

Styrenics

Engineering Polymer

Price Know-How: November 2022 Full Report

Visit the Price Know-How website to read the November 2022 update, including an in-depth analysis of each market segment and material group by Plastributions expert product managers.

Subscribe and keep in the know

Price Know-How is an industry-leading report to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at the leading polymer distributor, Plastribution, with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions, so you don’t need to!