Polymer Price Know-How: March 2022

- PlastikMedia Guest

- March 22, 2022

- 8 minutes read

The latest instalment of Price Know-How has been released by leading polymer distributor, Plastribution. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month, geopolitical issues dominate market sentiment.

Overview: March 2022

The Russian invasion of Ukraine has added further pressure to the upward trend of energy prices, with extreme consequences for crude oil, natural gas, energy and petrochemical feedstock prices.

Compared to the beginning of February, the price of Brent Crude surged by over £225 per tonne in early March, before falling back slightly mid-month.

Whilst Ukraine is a relatively small player in terms of polymer production and consumption, Russia has become a very significant supplier of polyolefins to the Western European market over the past few years and the removal of this source through either sanctions or countersanctions would create a significant vacuum, which would require substitution from other sources of supply. Whilst US origin PE may be well-positioned to substitute missing HDPE and LLDPE volumes, any PP shortfalls will be more difficult to address as the US does not have excess capacity for export.

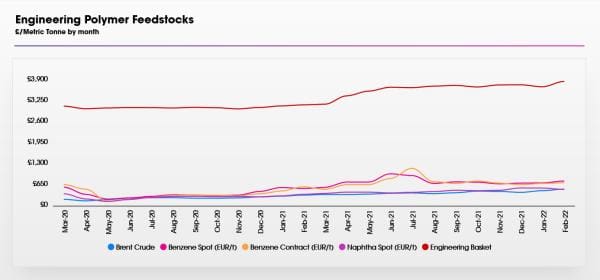

It is widely rumoured that some Western European polymer producers are facing a 10-fold increase in energy costs. This, combined with higher feedstock costs, is causing some producers of engineering polymers to suspend operations, instead relying upon supply from the Far East for polymer feedstock to make compounds. This move is likely to result in lower-cost materials being consumed rapidly, with the subsequent opportunity to push through the price increases necessary to make local production economically viable.

Despite the severity of the current situation, it is notable that the price levels of both Polyolefins and Styrenic polymers are below the record highs of Q2 2021 – a time when prices were being driven by the supply-demand balance for those polymers, rather than the cost of energy and crude oil.

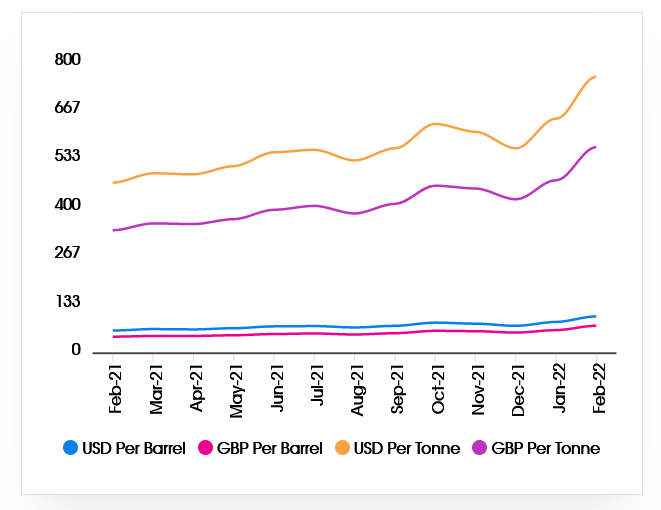

The current geopolitical crisis is both volatile and evolving. Whilst the initial market reaction has been to increase commodity prices, the graph below demonstrates that markets are also reacting to a range of factors that have the potential to either drive prices up or down, depending upon anticipated supply and demand, and what applies to crude oil pricing may also apply to polymer prices.

Oil Prices

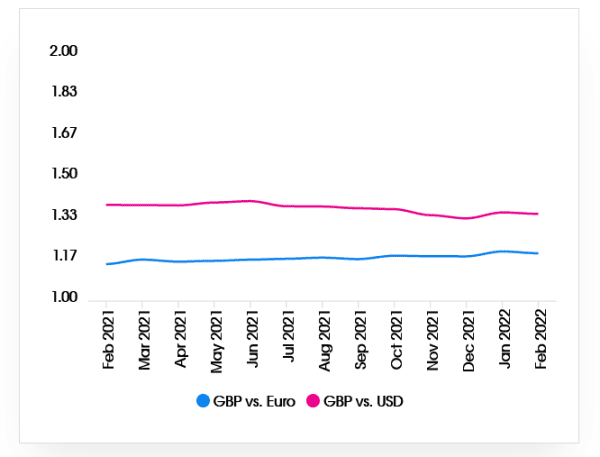

Exchange Rates

Whilst the GBP has been quite stable against the Euro throughout 2021, the USD has strengthened since mid-2021 and this has brought with it inflationary pressures for goods priced in $.

The potential delay in the Bank of England implementing further base interest rate increases has turned sentiment negative on the value of the GBP.

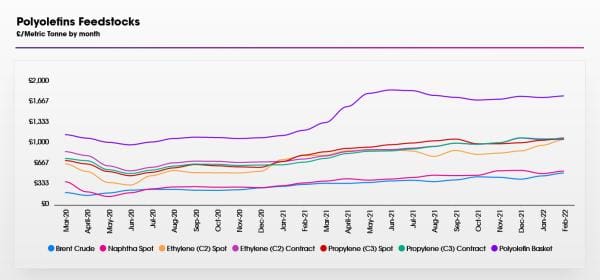

Polyolefins

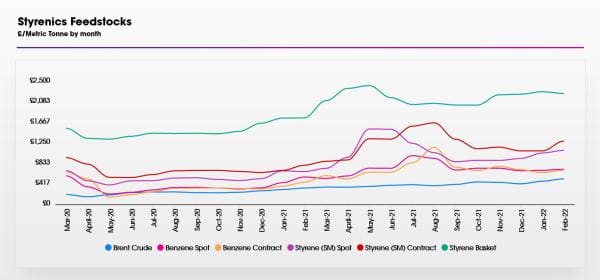

The graphics below are for illustrative purposes only. For full analysis, including in-depth insights from Plastribution’s expert product managers for each market segment and product group, view the full report for free on the Price Know-How website here.

Styrenics

Engineering Polymers

Price Know-How: March 2022 Full Report

Visit the Price Know-How website to read the March 2022 update in full, including an in-depth analysis of each market segment and material group by Plastributions expert product managers.

Subscribe and keep in the know

Price Know-How is an industry-leading report produced to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at leading polymer distributor, Plastribution with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions so you don’t need to!

To subscribe for free, and receive monthly updates directly to your inbox, please click here.

Plastribution

+44 (0) 1530 560560

Website

Email