Polymer Price Know-How: June 2023

The leading polymer distributor, Plastribution, has released the latest instalment of Price Know-How. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month, demand throughout the system is low and polymer converters are struggling to take full advantage of low-cost polymer with their own order books being scant; moreover, the raw material input cost reductions are being used to cover costs rather than being able to generate profit and positive cashflows.

Overview: June 2023

Deflationary pressure continues for all polymer types; how long can this situation continue?

Sluggish demand in the polymer sector is not just affecting the UK and the EU27. All regions and all applications are seeing a significant slowdown and polymer supply remains plentiful. In these circumstances, buyer behaviour becomes the polar opposite of a tight market with price inflation. Buyers are adopting both a ‘wait and see’ attitude on the basis that prices are likely to be lower tomorrow than they are today and not tying up valuable cash in inventory as economic uncertainties cause concerns throughout the supply chain.

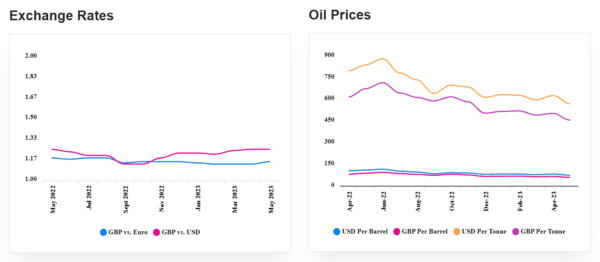

The drop in feedstock/monomer costs from May to June was greater than market expectations, and whilst it looks like C2 and C3 price reductions were underwritten by a corresponding reduction in Brent Crude, a decision by OPEC at the end of May resulted in oil prices rallying back up towards the average levels seen in May. If the recovery in Brent Crude is sustained there are likely to be significant implications for European Polymer Producers, who predominantly use Naphtha as feedstock and Naphtha prices typically track crude oil prices.

As the economics of most European polymer producers is already negative, this will cause losses to stack up further and sooner rather than later many will make the difficult decision to shutter production. In due course this will lead to a rebalancing of supply and demand with an expectation that prices will start to turnaround in late August, or early September after the European summer holiday season.

In the case of Engineering Polymers the situation of low demand continues to pressure prices with materials including ABS, POM and PC facing the greatest pressure as suppliers from Asia seek to recover sales in Europe.

Polyolefins

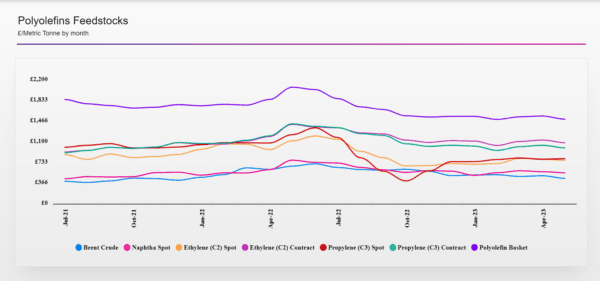

June has seen substantial drops in Polyolefin pricing following the Monomer reductions of €80 / MT for both Ethylene C2 and Propylene C3.

Price movements are in a wide range from product to product with PE under much more pressure due to significant oversupply and weak demand. PP is in a more balanced position and is typically moving broadly in line with monomer.

Outlook for July is looking like slight reductions as we’re probably still a month or so from seeing supply and demand getting back in balance, particularly on PE. Beyond the summer, many commentators are confident of an upswing both in demand and consequently an increase in pricing. Some suggesting a 15% swing back up by October. European Production continues to be limited to try and restore balance and it wouldn’t take a significant upward shift in sentiment to cause some short-term issues in availability.

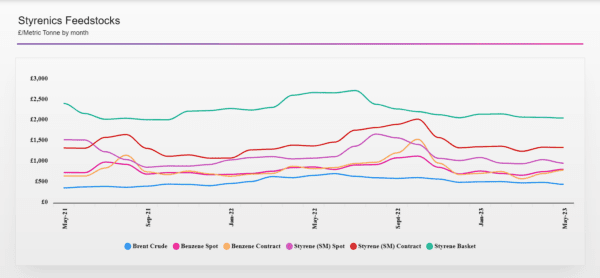

Styrenics

Engineering Polymers

Price Know-How: June 2023 Full Report

Visit the Price Know-How website to read the June 2023 update, including an in-depth analysis of each market segment and material group by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How is an industry-leading report to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at the leading polymer distributor, Plastribution, with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions, so you don’t need to!

To subscribe for free and receive monthly updates directly to your inbox please click here.

Plastribution

+44 (0) 1530 560560