Plastribution’s Polymer Price Know-How: 2024 Review and 2025 Outlook

|

Getting your Trinity Audio player ready...

|

2024 Review

The economy in 2024 continued to be dominated by the effects of the global economic slowdown. General inflation continued to moderate throughout the year, although remained above the Bank of England target of 2%, and on this basis, the base rate of interest was only reduced once in the period by 0.25% to 4.75%.

In addition to the continuing conflict between Russia and Ukraine, the conflict between Hamas and Israel continued and geopolitical tensions in the Middle East were a global concern throughout the year. At the beginning of the year Houthi terrorist action against commercial shipping in the Red Sea, raised concerns about supply chain security, delayed the arrival of goods from Asia and increased shipping costs as vessels diverted from the shorter Suez Canal route and sailed around the Cape of Good Hope.

After a small upswing from the shipping issues at the start of the year, the polymer market prices continued to trend lower. All sectors witnessed supply exceeding demand, a situation which for many materials was exacerbated by producer capacity increases. A small price upswing, for volume polymers, in the Autumn was not sustained as producers fought hard to win available volumes.

Prices remain at the level where polymer producers term the situation as ‘bottom of cycle economics’ resulting in idling and closure of plants where the financial performance is no longer viable. This effect was more pronounced in Western Europe, due to the higher cost of operating polymer plants in this region, and further polymerisation plant closures will result in an increased dependence on imports.

As in the polymer market, the risk of global recession weighed heavily in the energy sector, continuing to overtake geopolitical concerns that could affect the supply of oil and gas and prices remained depressed throughout the year.

Following a challenging 2023, polymer converters often struggled in 2024, with factors such as low demand in the automotive sector and further substitution of single-use plastics packaging with wood fibre alternatives impacting on demand. Low polymer prices provided some relief towards achieving adequate levels of financial performance.

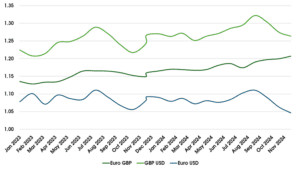

Crude Oil

Brent Crude traded in a relatively tight range of 73 – 89 USD per barrel. Prices increased steadily until April and then fell away until October when prices blipped on the back of fears of a wider conflict in the Middle East before stabilising at the end of the year.

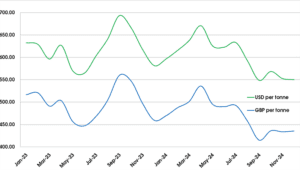

Exchange Rates

The Euro trended weaker against the GBP through most of 2024 with a gain of 5 cents over the 12 months.

The GBP: USD was more volatile with the dollar weakening in the run-up to the US elections, but thereafter recovered its losses by the year-end; the average monthly value ranged from 1.25 to 1.32 during 2024.

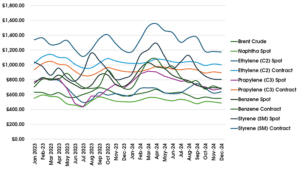

Feedstock

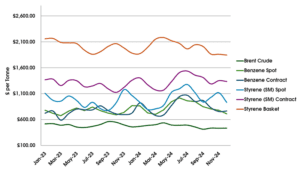

The volatility of aromatic feedstock continued in 2024, with both Benzene and Styrene monomers recording significant swings, which were often independent of Brent Crude and Naphtha. The olefin situation was dominated by over-supply, with spot prices trading at a significant discount to the contract values.

In the case of C2 high import penetration of competitively priced PE, suppressed demand, and although C3 is typically a co-product of Naphtha cracking from C2 production, any associated reduction was insufficient to avoid a glut of C3 and hence the large discounts for spot purchases.

It is interesting to note that all monomers recorded a moderate net gain in contract pricing.

Such was the state of demand for polymer raw materials, that producers were typically forced to pass through monomer discounts in full, with polymer converters typically resisting full monomer increases and often able to achieve discounts greater than monomer as competition for available volumes was intense.

The following graphs confirm the oversupply of both C2 and C3 with spot volumes selling at discounts versus Naphtha for at least part of 2024.

Overall, the economics of monomer production in 2024 was an improvement over the prior year.

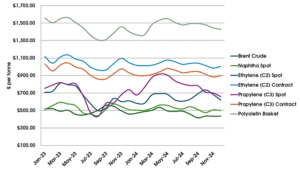

Polyolefins

The volatility of aromatic feedstock continued in 2024, with both Benzene and Styrene monomers recording significant swings, which were often independent of Brent Crude and Naphtha.

The olefin situation was dominated by over-supply, with spot prices trading at a significant discount to the contract values. In the case of C2 high import penetration of competitively priced PE, suppressed demand, and although C3 is typically a co-product of Naphtha cracking from C2 production, any associated reduction was insufficient to avoid a glut of C3 and hence the large discounts for spot purchases. It is interesting to note that all monomers recorded a moderate net gain in contract pricing.

Such was the state of demand for polymer raw materials, that producers were typically forced to pass through monomer discounts in full, with polymer converters typically resisting full monomer increases and often able to achieve discounts greater than monomer as competition for available volumes was intense.

The graphs clearly confirm the oversupply of both C2 and C3 with spot volumes selling at discounts versus Naphtha for at least part of 2024. Overall, the economics of monomer production in 2024 was an improvement over the prior year.

After close tracking of PE and PP price levels in 2023, 2024 saw PP pricing dropping below PE for the first time since late 2018. The primary reason for this change was the weak demand for PP in the consumable durables market with automotive and white goods markets being suppressed by low levels of consumer confidence.

The supply of PE from the USA that resumed in 2022 continued to be a dominant factor in 2024, with a strong flow of materials for film extrusion and blow moulding arriving at competitive prices. UK converters have become accustomed to the longer lead times and consequent need to often make forward price commitments in order to secure supply.

Styrenics

2024 was an interesting year in terms of styrenic polymer pricing, and the increasing price in the January to April period whilst contrary to falling input pricing reflects the influence of imports from the Far East at a time that shipping was being disrupted as a result of the Houthi attacks in the Red Sea.

Not only were shipping times increased as vessels diverted around the Cape of Good Hope, but in some cases the need for ships to take on additional bunker fuel resulted in delays and some cases, vessels returning to their port of origin. Thereafter prices fell away, until prices briefly increased in the late summer, before again receding.

Engineering Polymers

2025 Outlook

UK Economic Outlook

The engineering polymers market very much reflected the broader global economic situation with prices continuing to slide throughout the year. The high level of competition for available volumes eroded producer margins. Profitability stabilised from mid-year onwards.

The amendments to UK REACh and in particular the ATRM process will help to ensure that the cost of compliance for UK businesses will be significantly lower and will reduce the risk that some substances become unavailable due to prohibitive registration expenses.

Global Geopolitical Issues

The second Trump Presidency is likely to have a major impact on global politics. Attempts to resolve issues such as the Israeli conflict with Gaza, the Russian invasion of Ukraine and Houthi rebels from Yemen disrupting shipping, will contrast with increased taxation on goods imported into the US from which retaliations risk an escalation into a broader trade war.

In 2024 European and UK PVC producers successfully applied for the imposing of anti-dumping duty on US origin product. Whilst this action is to the benefit of the PVC producers, PVC converters are likely to suffer as a result of increased penetration by imports of semi-finished and finished goods.

Logistics

The combination of relatively low polymer prices, coupled with volatile container shipping rates has the potential to cause significant disruption in polymer supply. East-West routes are likely to be the most volatile.

The increased reliance of European polymer converters on polymer imports will add to the vulnerability of supply chains and more focus will be placed upon resilience in the year ahead.

Exchange Rates

The USD is likely to strengthen further as the Trump presidency gets underway. This will place inflationary pressure on imported PE from the US and imports of other materials from outside of Europe.

It is likely that Bank of England interest rates will remain higher than those in the Eurozone and this will likely maintain the GBP strength against the Euro.

Crude Oil

The likely scenario is that Brent Crude will continue to trade in the 70 – 90 USD per barrel range, with energy companies trying hard to manage supply in an economic environment that will tend towards falling prices.

It is notable that many traditional energy companies that have been heavily reliant on Crude Oil sales and derivatives have increasingly diversified their sources of revenue, with many now turning more to renewables for sustainability both for the planet and for their business models.

Taxes, PPT and Corporation Tax

The UK plastics packaging tax that came into effect from April 2022, at a rate of £200 per tonne for plastics packaging that contains less than 30% recycled content, was increased to £217.85 from April 2024 and is likely to be further adjusted by the rate of inflation in 2025.

In the case of plastic raw materials this typically costs about £1 per tonne, due to the liability incurred on plastic valve sacks. The more significant impact relates to the supply of plastics packaging where the liability applies to each tonne of packaging produced, with the last entity undertaking a ‘significant transformation’ picking up this tax liability. The opportunity to use chemical recycling and adopting a mass balance approach is likely to be approved following detailed discussions with HM Treasury.

The state of the UK Government’s finances is unlikely to afford any opportunity for tax concessions for either companies or individuals, although there is a commitment not to increase the rate of Corporation Tax in the lifetime of this parliament.

Feedstocks

Ethylene pricing is likely to be heavily influenced by the level of PE imports from the USA, which are expected to increase in 2025 and keep C2 pricing at relatively low levels.

C3 (Propylene) has a double reliance on crude oil refining in which C3 is a significant co-output of Naphtha cracking for ethylene and also a bi-product of the FCC (Fluidised Catalytic Cracking) process used to upgrade the petroleum fraction of crude oil distillate to the required environmental standards.

Whilst the ratio of C2 to C3 in the Naphtha cracking process can be adjusted, this is within a relatively narrow window and therefore low C2 demand along with refinery output rates will impact C3 availability. Demand for petroleum is likely to be reduced through the increased use of EVs.

Recovery in C3 demand to make polypropylene required for consumer durables, could tip supply/demand back in the favour of the producers. In turn this could lead to some cross-subsidy of C2, that is derived from Naphtha cracking.

Benzene is an important aromatic hydrocarbon compound which is the basis for the following intermediates including:

- Ethylbenzene

- Cumene

- Cyclohexane

- Nitrobenzene

- Linear Alkylbenzene

- Maleic Anhydride

- Others

Of which Ethylbenzene, Cumene and Cyclohexane are precursors to key monomers including SM (Styrene based polymers), Bisphenol A (PC) and HMXDA (PA66).

Price volatility is expected to continue, particularly as petrochemical producers seek to improve the economics of this important aromatic petrochemical compound.

The fortunes of styrene monomer (SM) are closely related to Ethylbenzene and in turn Benzene. An important characteristic of SM and the Benzene family is the relative ease with which these products can be shipped around the world in tanker vessels, and this tends to increase volatility as material is either distressed in the case of surplus and exported or imported in the case of shortage. SM is also a derivative of Propylene Oxide synthesis which is an important component of polyurethane manufacture, for use in markets such as automotive and furniture.

Polymer Groups

Polyolefins– 2025 will continue to be challenging for Polyolefins as more new capacity for all grades comes on stream and demand is not expected to match it. Highly commoditised grades such as PPHP, HDPE for blow moulding and LLDPE C4/C6 for film applications will be under the most pressure.

Oversupply in these sectors will push producers to increase output of more specialised grades which will bring downward price pressure in these more premium products

Styrenics– The situation for 2025 starts with some uncertainty. Polystyrene prices are likely to closely follow the volatility of SM (Styrene Monomer). Towards the end of 2024 several European ABS producers called for the imposition of anti-dumping duties on imports from Asia, but so far, no similar application has been made to the UK authorities, probably because there is no domestic ABS production.

Engineering Polymers– 2025 starts much the same as 2024 finished with downward pressure on prices and plentiful supply from producers across the board. It is expected that notations for most engineering polymers will continue to soften throughout the year, as competitive pressures continue.

Price Know-How: 2024 Review and 2025 Outlook

Visit the Price Know-How website to read the full 2024 review and 2025 outlook, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.

+44 (0) 1530 560560

Website

Email