Plastribution’s Polymer Price Know-How: October 2024

|

Getting your Trinity Audio player ready...

|

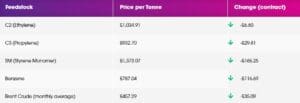

Plastribution’s October Polymer Price Know-How reflects ongoing volatility in the polymer market, with monomer prices under pressure amid concerns about global economic growth. Ethylene (C2) and propylene (C3) monomers continue to drop, influencing polymer pricing, while styrenics see an even sharper decline. Despite initial fears of supply disruptions from US port strikes and geopolitical tensions in the Middle East, market participants remain largely unconcerned, and demand remains weak. With new capacities added this year and the possibility of further industrial action in 2025, the outlook for the rest of 2024 remains uncertain.

Despite geopolitical tensions in the Middle East, crude oil prices remain under pressure as concerns about economic growth in China persist. The squeeze from lower crude oil pricing was directly reflected in C2 (ethylene) and C3 (propylene) monomers. The exaggerated fall in Benzene and SM (Styrene Monomer) was more surprising.

In the case of PE (polyethylene) the concerns about supply shortages from the US, resulting from dockworkers taking strike action along The Eastern Seaboard and The Gulf of Mexico have been very short-lived, albeit with a possibility that further industrial action my take place in January 2025 if a long-term agreement between employers and unions cannot be brokered.

In reality, any delays in shipping will be adequately covered by material already in the supply chain.

Given the backdrop of weak demand for polymers and finished products, it looks as if the monomer discounts will be applied to polymers, with the possibility of greater reductions if sellers have an appetite to chase available volumes.

Monomer Price Movement

Exchange Rates

€- 1.17

$- 1.29

€/$- 1.10

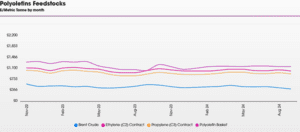

Polyolefins

Polyolefin prices are mostly falling in October following further reductions in Ethylene C2 and Propylene C3.

Some European producers have held out for rollover citing very poor economics of production. There were some initial concerns over port strikes in the USA and escalating tensions in the Middle East leading to shortages, but most market players seem unconcerned.

Demand continues to be relatively poor, with a general economic malaise. Supply continues to be plentiful with new capacities added this year for both PE and PP. Broadly speaking, the market has moved down by the monomer (around £30 / MT), but there are more spot deals available than in recent months. There are some bigger reductions from suppliers that tried stronger pricing in September as they look to move prices more in line with the market.

The outlook for the rest of 2024 suggests that prices will remain relatively flat to slightly down, but we face a final quarter with some uncertainty. US elections & Middle Eastern political tensions will have an influence before the end of the year.

Ian Chisnall predict that early in 2025, we should see a price rebound. Of course, a lot could happen between now and then.

Styrenics

Contract EU Styrene price collapses, EU polymer prices follow.

Styrene Monomer has fallen by €202T, settling at €1410/T.

For October, EU GPPS and HIPS fell sharply, and ABS reduced. EU materials have closed the gap with imports as deep sea materials have remained level.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

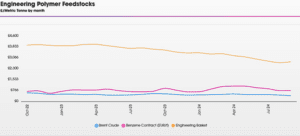

Engineering Polymers

October has started quiet. We are seeing further cutbacks in production and reducing prices for most engineering materials.

The October benzene contract settled €119/Mt lower than September at €805/Mt.

Sustainable Polymers

Recycled Polyolefins have mostly rolled over in October as producers have very little room to offer reductions from current levels. Whilst virgin prices have dropped, recyclers have not seen this pass through into their feedstocks and are unable to offer any kind of reduction based on their current cost position.

Demand seems to be OK with more interest in avoiding packaging taxes and offering a sustainable solution to end users.

Recycled LDPE / LLDPE

Recycled LDPE / LLDPE has mostly rolled over in October. High-quality grades continue to see strong demand and restricted availability leading to prices keeping above virgin.

Recycled PP

Recycled PP is trying for rollover in October, but prices are under pressure with availability still good and demand slightly weak, especially for the industrial quality grades. As with other recycled grades, high quality natural commands a strong premium over virgin.

Recycled HDPE

Recycled HDPE is typically rollover with industrial grades continuing to be under pressure. Natural grades for consumer packaging continue to see very strong demand in both injection and blow moulding. Significant premiums over virgin prices are continuing and industrial grades are under increased pressure as seasonal demand in sectors such as construction is low.

Price Know-How: October 2024 Full Report

Visit the Price Know-How website to read the October 2024 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.

+44 (0) 1530 560560

Website

Email