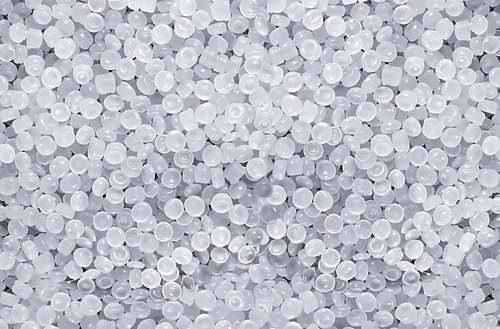

Latest Polymer Price Reports – May 2017

The latest polymer price reports and charts have been released by Plastics Information Europe (PIE).

Standard Thermoplastics May 2017: Notations predominantly sink / Styrenics show strong correction / PVC blends in exceptional state / Olefins drift downwards in June / Other polymer grades more stable

PE: European PE suppliers did not manage to convert the ethylene reference’s rollover into polymer prices in May 2017. Despite their hopes, oil and naphtha prices solidly remained in lower ranges after their slump in mid-April. Sinking spot prices and a run on imports caused by a strengthening euro undermined any efforts for price increases. In the end, discounts dominated the landscape, especially on the films sector. Speculative buying restraint contributed to further hefty discounts in a segment dominated by continuous and retroactively fixed contracts. By contrast, materials in relation to the construction sector often saw lesser decreases due to the high demand generated by a season in full swing. At least the first half of June is likely see further substantial discounts. The ethylene reference is setting a clear sign. In some segments, suppliers still might be tempted to go for a trend reversal. Many special offers at the end of May indicate a targeted reduction of inventories. With a lower availability of materials, the remaining stock could then be sold at higher prices. Nevertheless, much will depend on how much buyers will give up their reluctance in the relevant segments.

PP: Despite rollover of the C3 reference contract beforehand, European PP prices crumbled in May 2017. Globally, the C3 chains weakened, including polymers. Also, more goods than before were available from European production once again. By exercising tactical restraint, buyers also brought additional pressure to bear on prices. The copolymer grades, that have risen at disproportionate rates – almost continuously since last autumn – underwent a similarly disproportionate fall. Many consider that the gap versus the homopolymer grades calls for correction. The compounds similarly moved downwards on a pro-rata basis. The links to standard-grade materials were clearly noticeable again here. More extensive reductions are likely in June. The propylene reference contract mirrored the decline in the naphtha level since mid-April. And this will have a direct impact on polymers too. Since tactical options are open to purchasers, due to import offerings at yet non-fixed prices, the falls could even surpass the drop in the reference contract for some grades. Compounds will no doubt adapt the pattern followed by both the C3 and the standard grades.

PVC: May 2017 was a month marked by unpleasant experiences for PVC materials converters and users in Europe. While the price of the polymer matrix material remained stable on all fronts, given the rollover of the ethylene reference contract, the additives caused ready-to-use materials to skyrocket. The situation for titanium dioxide has now been tight for more than six months and stocks are exhausted worldwide. Allocations and postponed deliveries are now also affecting what were previously highly remote applications within the chain. The rising costs are inevitably reflected in the material notations. And, as if this were not enough, plasticisers then prompted a further major upward thrust. Two of the big three European suppliers have announced extremely pronounced delivery problems in some cases, and prices for the much sought-after DINP shot up by more than EUR 300/t in next to no time. Given the very high filler levels frequently found in soft blends, the hikes in May are probably, unfortunately, only an initial indication of what is to come over the next few weeks. At the same time, standard grades of PVC polymer ought to be moving more in the opposite direction, even if only to a moderate extent.

Styrenics: The price correction of styrenics has continued in May 2017. After the end of the previous boom, the SM reference contract marked its second steep drop in a row, this time by EUR 245/t. The essential feedstock’s trend was of course followed by styrenics, but producers generally did not pass on the entire cost decrease to their customers. PS and EPS prices are back below their five year averages, but ABS continues to fly high. High discounts and speculation that June will see no further significant price reductions generated a strong overall demand. Many processors purchased above their current need to build up inventories. In June, the SM notation trended up again: the mean value of two differently agreed contracts was at EUR 42.5/t. In view of the SM increase, PS and EPS prices are also likely to increase in June, while ABS continues to have more potential for moderate prices because of the strong decline of butadiene by EUR 300/t.

PET: PET prices essentially followed the falling feedstock costs in May. Notations in Asia similarly fell until early May. However, these stabilised in the course of the month and, coupled with an increase in demand, also firmed up spot prices in Europe in the second half, keeping reductions for normal business in check too. Hence producers in Europe got by without having to pass on their full cost savings. Recyclate prices were also displaying firmer tendencies by mid-month. Demand clearly picked up in May. The sunny weather forecast for June is set to boost demand from the bottle sector once more, and a good season is imminent. If feedstock prices move upwards slightly, PET notations will similarly increase. All in all, however, the trend is likely to be one of stabilisation.

Engineering Thermoplastics May 2017: Rollover predominates / Tight supply situation still exists with PC, POM and PMMA / Potential upward trend even before start of Q3 / Demand expected to slow down a little

With only a few exceptions, the majority of engineering plastics became stuck in a rollover in May despite that some feedstocks tended firmer. Producers had already factored in most of their announced increases and there were only occasional further hikes. The tight supply situation with PC, POM and PMMA did not improve in view of the continuing lively demand from the automotive industry. On the other hand, the additional trend towards securing volumes declined a little compared with recent months. POM also suffered due to a lack of Asian imports. The fact that the Plastixx curve nevertheless tended downwards is due to the large fall in the price of ABS, as these types are assigned to the engineering thermoplastics group.

The final month of Q2 is likely to remain stable with fresh increases not coming until the beginning of July. Many producers have already made announcements to this effect. In the case of PA 6, converters are speculating that notations will soften. Things are likely to calm down a little as far as ordering activity is concerned in view of the impending holiday period. Automotive demand is also expected to decline in the summer.

Only with POM, PBT and PMMA might producers call for hikes before the end of the quarter, and the tight availability of feedstocks and polymers could also affect the longer-term contracts. With POM, intervention by the copolymer suppliers would be conceivable, as they have – unlike the homopolymer producers – so far remained quiet. The same applies to the very tight PMMA situation, for which one producer recently called for potentially record-breaking increases. Here, too, prices could well move before the beginning of July. The price hike announced by one major BDO producer could also push up PBT, although the polymer itself has so far been spared the rises.

For more than 34 years, PIE has been an invaluable source of information for European plastics industry decision makers – a quick, yet in-depth look at the development of plastics markets and polymer prices. Available online 24/7 and as a printed newsletter twice a month. To read the entire report, go to www.pieweb.com and sign up for a 48-hour free trial!