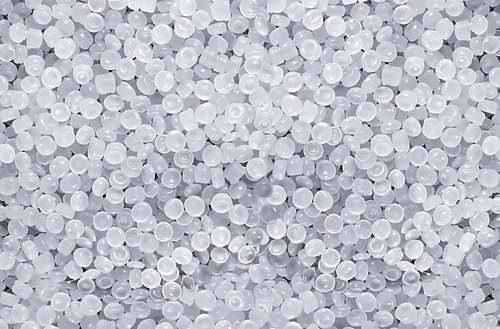

Latest Polymer Price Reports – March 2017

The latest polymer price reports and charts have been released by Plastics Information Europe (PIE).

Standard Thermoplastics March 2017: Price rises likely reached their zenith / First reductions in view with drop in styrene prices / Maintenance downtime reduces supply / Demand normal

PE: Following the rise in the C2 reference contract, polyethylene prices rose in March. HDPE producers were able to pass on the costs at minimum, while LDPE and LLDPE suppliers generally managed to push through a small margin improvement, too. The many calls for triple-digit increases, however, proved overly ambitious. Supply was reduced by scheduled and unscheduled shutdowns. Especially with HDPE pipe grades and certain LLDPE types, there were reports of allocations. Imports were unable to completely fill the gaps in demand. April is likely to see further small increases. Although the C2 reference contract stuck at its previous month’s level and demand is likely to be somewhat slacker due to the Easter holidays, the limited supply situation is playing into the hands of the suppliers with regards to their price hike wishes.

PP: On the back of a propylene price rally in the US in the first two months of 2017, producers achieved margin gains. In March, polymers followed the trend. For the most part, the gains were moderate, in line with movements in the C3 reference contract; however, buyers who had been paying the low prices effective in the final quarter of 2016 faced hefty increases. Following the trend of the past several weeks, compounds continued to see substantial hikes. In April, notations can be expected to climb further upward. Even if propylene saw only modest gains of around EUR 15/t at the beginning of April, PP producers will be bent on improving their margins, so that additional increases in the range of EUR 30 – 50/t look very likely. To what extent the supply side will be able to achieve gains of this dimension will depend largely on the development of demand in the short working month of April. The maintenance turnarounds already in progress at crackers and downstream plants will begin to make a major impact on pricing in April. Imports could bring some price relief, although these deliveries are unlikely to be in the market before the end of the month.

PVC: There was lower output from European producers due to maintenance works at major plants, a rewarding outflow into exports in the first half of the month and costs increasing on all counts – while demand ran at a normal level. The market situation in March 2017 was ideal for raising the margins of Europe’s PVC producers. Only in isolated cases did suppliers manage the EUR 80/t increase they had been aiming for, but with the EUR 50 – 60/t achieved overall, the hike was sufficient to put producers in a happier mood. The rise of EUR 15/t nominally attributable to the ethylene costs was clearly exceeded. In the wake of these hikes, upward movement was also seen in soft PVC blends and paste PVC. In the meantime, the deteriorating supply and cost situation for titanium dioxide lifted the rigid blends (PVC-U) through a price barrier. For the very first time since the PIE ranges for PVC compounds were introduced in autumn 2012 – due, back then, to an unusual situation prevailing for titanium dioxide too – the notations for rigid material have exceeded those for flexible materials. Hence, an extremely unusual situation. Prospects for April include further increases for the base material, although the supply situation ought to improve over the course of the month. The soft compounds will move in the same direction. With the rigid compounds, by contrast, disproportionate hikes are to be feared again. Titanium dioxide will doubtless move upwards again due to the extremely tight supply in some areas, and similarly lifting notations for PVC (U).

Styrenics: After the SM reference contract’s latest increase of EUR 90/t in March 2017, all styrenics prices have reached new all-time highs. The high price level stifled demand. Players bought only absolutely essential volumes if they could.

Purchases crumbled even further in the second half of the month. Where possible, processors postponed their orders. There is a silver lining: the market is shifting. For several weeks SM spot prices have been eroding and April finally sees the styrene reference contract also losing EUR 275/t now, which will ultimately bring down styrenics prices. However, producers will insist on keeping a fair share of the price/cost margin on the grounds that they did not pass on the entire cost increase during the boom either; for ABS, butadiene’s rollover will additionally flatten the curve. Purchasers will still benefit from three-digit discounts across all styrenics. The price trend reversal should act as a buying signal for many processors, who generally have kept their stock levels low during the price rally. But suppliers did the same, so a strong run for materials could lead to bottlenecks for many grades.

PET: Although the cost side remained stable in March, European PET producers were able to achieve moderate price increases in March 2017 once again. High-volume deliveries below the PIE range for small to medium volumes also rose in parallel and are slowly approaching the EUR 1,100/t mark. Europe’s producers exploited the somewhat tight situation on the market to improve their margins. Imports from Asia remained absent, on the one hand, and output rates in Europe fell slightly, on the other. In the wake of the hikes for virgin material, regrind suppliers were also able to increase their revenues. Since the start of the year, margins have risen slightly by EUR 15 – 20/t. In the case of secondary material, rising prices still have to be expected for post-consumer PET, since the hike in virgin PET of the past months still has to make its way right through the chain. In North America, notations for virgin material slightly rose. In Asia, by contrast, the temporary winter boost seems to have come to an end. Prices have undergone a notable fall. The cost boom in the Far East is a thing of the past. Europe’s PET suppliers have whetted their appetite with the margin improvements of the previous month and are naturally eager to push through further increases. The cost momentum will doubtless put a stop to this. And, with the pull of arbitrage, Asian suppliers are increasingly looking towards Europe once again. Initial reductions could even result if feedstocks were to yield. These could, however, be held in check if good weather at Easter and afterwards were to trigger an upswing in demand.

Engineering Thermoplastics March 2017: Market swamped by wave of price hikes / Polyamide notations skyrocket / Further increases expected in April / Upward pressure will continue

In March, the European market for engineering thermoplastics was, as predicted, flooded by the global wave of costs that has been building since the beginning of the year. Most notations for all types and grades included in this report jumped sharply, a few only moderately. This time it was the polyamides that set the pace, with increases amounting to at least EUR 200/t. Global prices for the majority of feedstocks in the PA chains had exploded to such an extent in the previous weeks that triple-digit hikes barely raised an eyebrow. It was the PBT grades that experienced the smallest rises, but with PMMA, the situation intensified again quite significantly.

Commodity-related ABS again registered triple-digit increases because of the higher composite costs. Prices climbed to a new record high.

The substantial rises with PP compounds in recent weeks continued in March. Both sets of buyers – with the traditional bond to C3 and with an orientation to standard PP – suffered price rises above the increase in the monomer or raw material costs. The automotive industry was a particularly strong driver. The constantly rising prices and the hedging purchases connected with this provided for additional dynamism.

Even if there are clear indications, especially in Asia, of a turnaround – for example, with the aromatic chains – European prices of engineering thermoplastics are likely to move up again in April. The cost increases in the previous months have simply been too large. Furthermore, higher quarterly agreements will push rates up on the open monthly markets. Yet, despite the pessimists, this phase of hefty price rises should come to an end fairly soon. It is expected that things will calm down again towards the end of spring. On the other hand, significant corrections are expected for ABS as early as April, as the main cost driver styrene has undergone a huge fall to bring to an end the high that had lasted for so many months.

The small rise in the cost of C3 has not initiated another window of change with PP compounds at the beginning of April. Correspondingly, fixed agreements should end up with a rollover. This does not, however, apply to standard PP-oriented orders, where moderate increases of EUR 30 – 50/t are expected.

For more than 34 years, PIE has been an invaluable source of information for European plastics industry decision makers – a quick, yet in-depth look at the development of plastics markets and polymer prices. Available online 24/7 and as a printed newsletter twice a month. To read the entire report, go to www.pieweb.com and sign up for a 48-hour free trial!