Energy Market: Moving Forward Post COVID-19

As the UK is starting to move past the peak of the COVID-19 pandemic, what does this mean for energy prices moving forward? Alex Rubboli, Senior Energy Consultant at Utility Team investigates.

National Balancing Point (NBP) Gas

One of the side effects of Covid-19 has been a drop in energy prices across the UK, which can be seen in the graph below, which summarises the National Balancing Point (NBP) (source: Cornwall Insights). The NBP is explained by Ofgem: ‘The wholesale gas market in Britain has one price for gas irrespective of where the gas comes from. This is called the National Balancing Point (NBP) price of gas and is usually quoted in price per therm of gas.’ This demonstrates the overall pricing impact.

As we head into the summer, gas consumption levels are considerably lower than the levels typically observed in April / May of a given year. This is partly due to the impact of lockdown measures, with industry across the UK shutting down, therefore lowering demand, but also down to the fact that this April has been one of the warmest on record. These factors have contributed to low levels of gas demand on the National Transmission System (NTS).

If we look ahead to the summer, demand on the NTS (which is already 10% lower than typical levels for the time of the year) is currently forecast to fall even further.

Gas storage in the UK is also at a five-year high for this time of year, and with the continued arrival of LNG tankers to GB terminals, the gap between gas supply and demand in the country continues to widen, which could have a positive effect on gas prices for the consumer, be it business or domestic.

Power

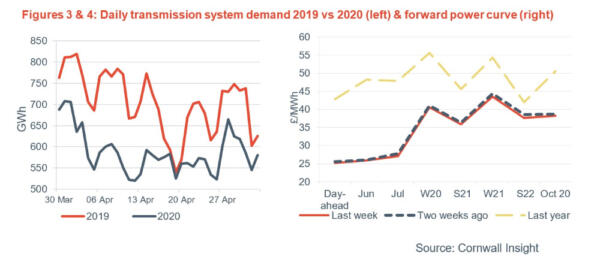

The UK power market has been dominated by the gulf in demand left by the COVID-19 lockdown, which started on the 23rd March, demonstrated in the graph below. (Source: Cornwall Insights). This has seen the average power demand for the working week fall by approximately 20% over April.

The impact of this increased solar PV production and the extra daylight hours will continue to weigh on transmission demand over summer months, but the gradual ease of lockdown measures should be an offsetting factor.

A recovery to pre COVID-19 demand levels is highly unlikely. Experts are no longer predicting a swift return to commercial and industrial activity levels seen before lockdown, and this will take its toll on demand. As a result of this, a surge in UK gas and power demand and the knock-on effect on prices this has had, is unlikely to be seen in the coming summer months.

The energy market has been favourable due to COVID-19, looking into the future it’s highly likely this trend will continue. Contact us here at the Utility Team to make the most of the currently favourable market and ensure you secure the best deal possible for your business.

Contact Utility Team today at enquiries@utilityteam.co.uk or 02476 997 901.

This article was written by Alex Rubboli, Senior Energy Consultant at Utility Team. To view the original article, or the company news archive, visit the Utility Team website.

Utility Team

02476 997 901

Website

Email