Plastribution’s Polymer Price Know-How: December 2024

|

Getting your Trinity Audio player ready...

|

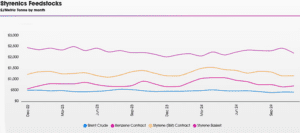

Plastribution’s December Polymer Price Know-How discusses how the market is still heavily influenced by weak demand and supply-demand imbalances. The stronger USD continues to exert cost pressures on polymers imported from outside Europe, while European prices remain constrained by low purchasing activity. Polyolefin prices remain stable, with limited movement, while styrenics and recycled polymers reflect ongoing challenges in maintaining inventory levels amid subdued market activity. As the industry prepares for seasonal shutdowns, 2025 is expected to bring fresh developments, including potential price adjustments and structural changes within the sector.

Whilst a $0.03 increase in the value of the USD against both the GBP and Euro should drive cost inflation both directly for polymers sourced from outside Europe, which are typically priced in USD, and indirectly through feedstock costs for European petrochemical producers, where Crude Oil is priced in USD, the stark reality is that supply demand balance is of paramount importance.

From the viewpoint of polymer buyers, it matters little whether the weakness is resulting from lower monomer costs or stiff competition for scant polymer orders. The extent of price movements is polymer specific and, with the exception of some rollovers on tighter and more specialist grades, the tendency is still towards lower prices throughout November and into December.

The start of 2025 is expected to be dynamic as demand returns to normal, following the seasonal converter shutdowns in December and as polymer suppliers contemplate price increases in order to improve beleaguered margins.

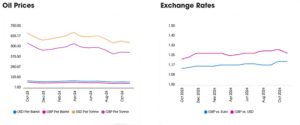

Exchange Rates

€- 1.20

$- 1.27

€/$- 1.06

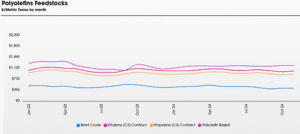

Polyolefins

Polyolefin prices are mostly rolling over in December, with some grades under a little bit of downward pressure.

Whilst Ethylene C2 and Propylene C3 both reduced by €7.5 / MT and €10 / MT respectively, many producers are not agreeing to pass these on as they swallowed much bigger monomer increases in November. Demand continues to be poor and consequently, there are some deals available from traders.

Outlook for the New Year is for a rollover to begin with and then some strengthening of prices around February. Producers can’t keep making losses indefinitely so at some point, there will be a change in approach. 2025 could be a volatile year with potential plant closures and further rationalisation in the European industry. Add to that some uncertainty with potential new tariffs on major trade flows, with possible impacts on freight rates and availability, we could be in for a rocky period.