Plastribution’s Polymer Price Know-How: August 2024

|

Getting your Trinity Audio player ready...

|

Plastribution’s August Polymer Price Know-How highlights the rise of polymer prices, with August seeing notable increases across various grades, especially in the polyolefins and styrenics markets. The tightening of monomer supplies and rising freight costs continue to influence price trajectories. Buyers remain cautious, balancing the need to secure inventory against uncertainty about price sustainability.

Prices edge forward in August, with further increases likely to be implemented as September approaches.

In July it was already evident that ‘special deals’ on PE and PP standard grades were no longer available, and the £16.93 (€20) per tonne increase applied to the August contract price for C2 and C3 went on to send a clear signal to the market that prices are back on the way up. In some cases, producers have outlined ‘triple-digit’ increases, particularly for LDPE, although the timing of these adjustments is a little vague, and September may be the backstop for implementation.

Buyers at polymer converters are looking for opportunities to secure inventories at attractive prices. However, many remain sceptical about the durability of any increases and expect that prices will moderate in the final quarter of 2024.

On a separate note, the styrenic polymer value chain provided a classic response to changes in availability. In this instance, an SM (Styrene Monomer) outage at the Shell Moerdijk plant in the Netherlands caused a price spike as polystyrene producers became concerned about feedstock availability.

Geopolitical tensions in the Middle East, are also a topic of speculation. As with the polymer market, crude oil price action continues to bounce between the risk of a larger-scale conflict causing supply shortages and weak consumer demand. Any escalation of conflict in the Middle East region would likely push crude oil and polymer pricing in a clear upward direction.

In the interim, high shipping costs continue to influence imports of ABS and engineering polymers from Asia.

With just a couple of weeks until the summer season ends, the September price action will soon become evident.

Monomer Price Movement

Exchange Rates

€- 1.18

$- 1.27

€/$- 1.08

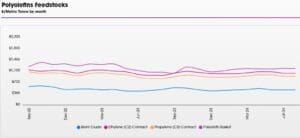

Polyolefins

With both monomers Ethylene C2 and Propylene C3 increasing by €20/MT, Polyolefin prices are continuing to climb in August. Most grades are achieving increases above the monomer with some seeing restricted availability and slightly better demand.

European Production is being scaled back to match supply with the muted demand and imports continue to be limited. Imports are lower because of high freight rates (though these are starting to ease) and better returns in other parts of the world.

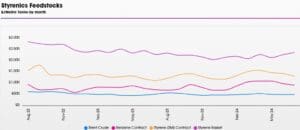

Styrenics

Contract EU Styrene rises, EU polymer prices follow.

Styrene Monomer has risen by €78T, settling at €1620/T, due to shortages in EU production.

For August, EU GPPS, HIPS and ABS have risen. Deep sea materials have increased due to rising shipping costs, and all FR materials are increasing due to steep rises in Antimony Trioxide notations, attributed to increased demand in China for Solar Panel production.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

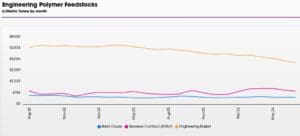

Engineering Polymers

The situation remains broadly the same in August as it was in July, i.e. fairly quiet during this traditional holiday season for many in the UK and parts of Europe. Weak demand and sufficient supply are the current comments for most engineering materials. The August benzene contract settled €84/Mt lower at €906/Mt, however, Polycarbonate has seen an increase from Asia due to rising sea freight costs. Producers of PMMA forged ahead with three-digit increases due to the ongoing shortage of MMA.

Sustainable Polymers

Recycled materials have seen rollover to slight increases in August depending on the quality and availability of the product. With virgin prices climbing, demand for recycled grades has strengthened and some recyclers have increased their offers accordingly. Demand for consistent quality natural grades continues to grow as brands push their “Green” credentials.

Recycled LDPE / LLDPE

Recycled LDPE / LLDPE has increased slightly in August, but some have conceded rollover as although demand is slightly better, there is still spare capacity in the industry, particularly on the less popular, lower quality grades.

Recycled HDPE

Recycled HDPE is around rollover with virgin prices for HDPE not increasing as much as other PE grades. We continue to see strong demand for natural grades, particularly in consumer packaging such as toiletries. These grades continue to command a significant premium over virgin.

Recycled PP

Recycled PP is also around rollover as although virgin PP has increased around €30-50/MT in August, we still see very good availability of recycled PP, especially in the black and wide specification grades. Some small increases have been reported but are typically in the higher specification grades.

Price Know-How: August 2024 Full Report

Visit the Price Know-How website to read the August 2024 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.

+44 (0) 1530 560560

Website

Email