Plastribution’s Polymer Price Know-How: March 2025

|

Getting your Trinity Audio player ready...

|

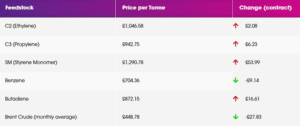

Plastribution’s March Polymer Price Know-How shows minimal movement in monomer prices following February’s increases. Polyolefins have largely rolled over, though LDPE remains an exception due to tighter supply. The uncertainty surrounding potential EU tariffs on US PE imports continues to cast a shadow over global trade flows, with supply chain disruptions likely in the months ahead. Meanwhile, Styrene Monomer has seen a significant price increase, and engineering polymers remain under pressure despite price hike attempts. The outlook for Q2 depends on evolving trade policies and supply adjustments.

The modest increases in C2 (Ethylene) and C3 (Propylene) polyolefin feedstocks look like hard-fought battles between buyers and sellers, with C3 sellers fairing slightly better. The impact on spot PP and PE pricing is likely to be limited as supply of both materials remains abundant.

The increase in Styrene Monomer (SM) appears to be supply and demand-based, despite the fall in Benzene costs which is a common feedstock for SM production along with SM being a co-product from PO (propylene oxide) manufacture (feedstock for polyurethane). Some recent announcements concerning the rationalisation of PO may have been of influence.

With the Easter holidays falling towards the end of April, demand will not be choked by seasonal holidays and this should keep prices firm for all polymers through until the end of the quarter.

Monomer Price Movement

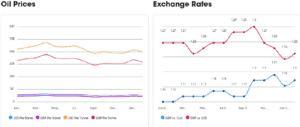

Exchange Rates

Exchange Rates

€- 1.20

$- 1.25

€/$- 1.04

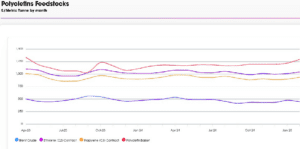

Polyolefins

March has broadly gone with rollover with minor movements in monomers not pushed through following the monomer plus price increases of February. Ethylene C2 increased by just €2.5 / MT and Propylene C3 by €7.50 / MT.

LDPE is perhaps the one grade that may see further increases due to tighter supply and reasonable demand. All other grades are seeing rollover so far.

The outlook for the short & medium term is very uncertain as the impact of tariffs on US imports is not clear. Whilst it seems very likely that the EU will impose tariffs of 25% on imports of PE from the USA, we don’t know if the UK will follow. If we don’t impose tariffs, we could be overwhelmed with material as US producers focus on us but if we do impose tariffs, then prices will inevitably rise. The tariffs will significantly affect global trade flows and could lead to some serious supply chain disruption as we adjust to importing material from other locations.

We can source LLDPE and HDPE from the Middle East, but it will take time for these routes to become established again with the continued Suez disruption. This effect will mostly be felt by PE but there could be spillover into PP if we see a lack of container availability and space at Middle East ports. PP can also be supplied from the Far East, but it could take months for supply routes to adjust.

European Petrochemicals Industry continues to see reports of further planned rationalisation whilst the first half of March has seen oil prices dropping. With it, Naphtha, we may not see this passed through to monomers due to cracker outages and tightness of supply. Spot prices for C2 and C3 have risen this month on the back of tight supply.

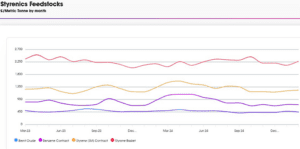

Styrenics

Contract EU Styrene rises again.

Styrene Monomer has increased by €65/T, settling at €1554/T.

For March, EU GPPS and HIPS increased by €65/T and EU ABS followed (+€50/T). Import ABS Rollover

GPPS/HIPS/ABS supply chains are still running at reduced rates, no doubt triggered by low demand. Converters and distributors are also running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

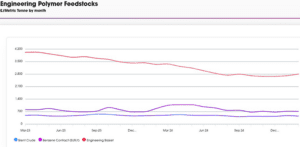

Engineering Polymers

February sales levels were similar to January, and order activity was OK. Some volumes from key market areas were missing, and demand for March is likely to be comparable with no meaningful changes. There have been some price increase announcements for Polyamide from the larger producers, however, the market is extremely competitive with plentiful supply so it is unlikely they will be realised.

The March benzene contract settled €11/mt lower than February at €848/mt.

Sustainable Polymers

Recycled Polyolefins have seen mostly rollover in March as most grades are following the trends in virgin grades. Demand is still slightly weak with key sectors such as construction still struggling, but there are signs of improvement in the medium term with increased taxes on packaging stimulating some growth.

Recycled LDPE / LLDPE

Recycled LDPE / LLDPE has rolled over in March. High-performance grades offering prime performance whilst meeting the requirements of the packaging tax continue to demand a strong premium over virgin grades.

Recycled HDPE

Recycled HDPE has rolled over in March, whilst some market sectors are down, others are up, and the overall market is reasonably balanced. High-quality natural grades for packaging have seen increased demand this month.

Recycled PP

Recycled PP has mostly rolled over, and demand from the key sector of Automotive continues to be weak in the short term although the longer-term future appears much brighter. More interest in higher quality grades as companies look for ways to lower their carbon footprint and the saving in CO2 from virgin to recycled PP is significant.

Price Know-How: March 2025 Full Report

Visit the Price Know-How website to read the March 2025 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.

+44 (0) 1530 560560

Website

Email