Polymer Price Know-How: July 2023

The leading polymer distributor, Plastribution, has released the latest instalment of Price Know-How. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month, the market is still very well supplied and with poor demand in key sectors, it continues to be a buyer’s market.

Overview: July 2023

Price pressure intensifies as supply continues to exceed demand.

Demand in June remained weak and polymer supply was plentiful. Given the high levels of inventory on the supplier side there was plenty of competition as sellers looked to move inventory through the supply chain in order to both clear warehouse space and generate cash. Some deals on volume polymers resulted from the need to create physical storage space so that containerised imports could be cleared from port in a timely manner in order to avoid expensive demurrage charges.

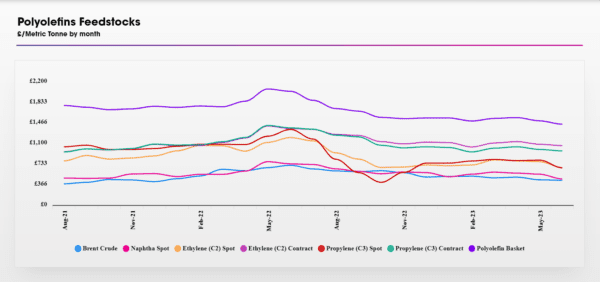

Large converters saw price reductions for volume polymers in June greater than the respective drop in contract feedstock. The economics of this are largely based upon the relative fall in spot monomer costs, through which polymer producers who purchase feedstock on a spot basis could take advantage of very low input cost. The following graph clearly depicts the difference between spot and contract C2 and C3 since the beginning of January 2022 when the deltas were effectively nil. The current spot price of C2 and C3 against Naphtha does not look sustainable and as has been the case with polymer production, will likely lead to the idling of further Naphtha cracking capacity.

Monomer Price Movement – July

The July feedstock contracts have again fallen from the June levels, albeit a more moderate reduction. In the case of volume polymers, it appears that the bountiful supply is enabling large polymer converters to take full advantage of these reductions and in some cases further discounts have been negotiated.

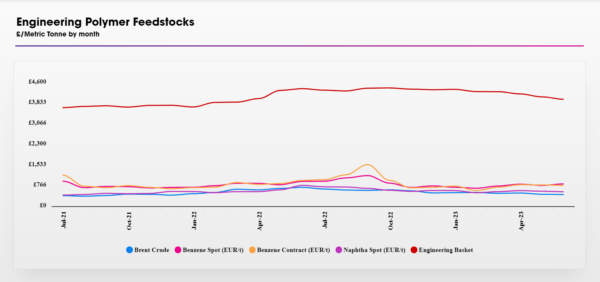

The situation for more specialised polymers is mixed, with strong competition from Far East imports for some of the more standard grades of POM and PC, where converters have the flexibility to use a variety of materials. In the case of speciality grades, suppliers will do as much as possible to work through higher-priced inventory before passing through cost reductions in full or part.

Whilst at this point the market sentiment looking forwards into August is likely to be the same, there is the need for some caution because as producers idle more and more capacity, there will come a tipping point at which inventories will be depleted and demand will exceed supply. Some indications are that some of the large converters who are speculative buyers are starting to increase inventories as they see the market approaching ‘the bottom point’. Many players are indicating that the end of August may represent the tipping point.

Polyolefins

Whilst not quite as dramatic as June, July has seen further falls in Polyolefin pricing though typically more in line with the monomer reductions this month. Ethylene C2 dropped €40 / MT and Propylene C3 dropped €50 / MT.

Market is still very well supplied and with poor demand in key sectors, it continues to be a buyer’s market. Some suggestions that we are close to the bottom of the market with these reductions being the last of any significance this year. Whilst August may see relatively flat conditions, there are expectations of a small price recovery in September or October.

But the fundamentals of polymer supply and demand are still not great. Virtually all European plants are running at technical minimums with millions of tons of capacity taken out this year. But this is more than offset by significant new global capacity for both PE and PP.

Warehouses in the main European hubs are reported to be full and with more products on the way, traders are looking to secure deals to move volume to converters.

However, there are suggestions that much of the Polymer Supply “Pipeline” is running quite empty with many participants in the value chain (converters, distributors, end users etc.) holding the minimum stock possible. Whilst it is currently still possible to run on a “Just In Time” basis with a strong supply, it wouldn’t take much of a blip to disrupt this fine balance.

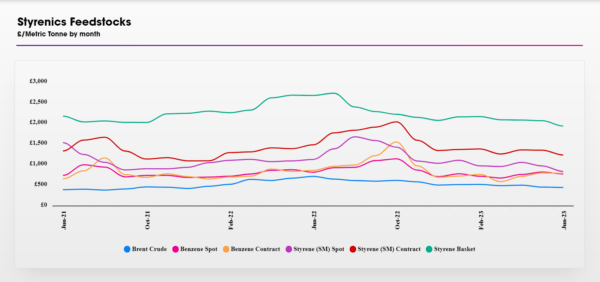

Styrenics

Engineering Polymers

Price Know-How: July 2023 Full Report

Visit the Price Know-How website to read the July 2023 update, including an in-depth analysis of each market segment and material group by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How is an industry-leading report to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at the leading polymer distributor, Plastribution, with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions, so you don’t need to!

To subscribe for free and receive monthly updates directly to your inbox please click here.

Plastribution

+44 (0) 1530 560560