Polymer Price Know-How: October 2022

The latest installment of Price Know-How has been released by the leading polymer distributor, Plastribution. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month, the “mini-budget” wreaks havoc for exchange rates, and energy costs remain high with an increasing number seeking to apply energy surcharges to base polymer prices.

Overview: October 2022

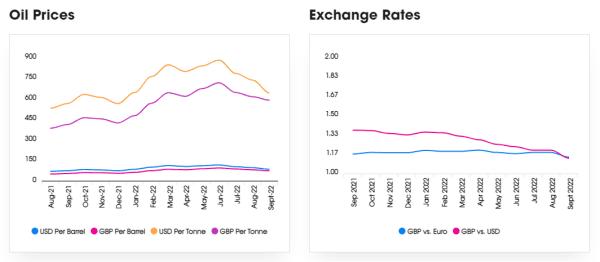

The now former Chancellor of the Exchequer’s ‘mini budget’ announced on September 19th caused significant concern about the prospects for the UK economy, which resulted in a significant devaluation of GBP and was further exaggerated by a strengthening of the USD. Fortunately, the situation improved at the end of the month and with this the prospects of currency related polymer price increases for UK plastics converters was largely mitigated.

The issue of increased energy costs remains a vexed question amongst polymer producers, with an increasing number seeking to apply energy surcharges to base polymer prices. This approach creates some difficulty in determining the actual price of polymer. None-the-less, the economies of polymer production continue to look challenging and clear efforts are being made to reduce output in order to match supply more closely with demand.

For standard polymers it is increasingly a question of when, rather than if, prices will increase.

Polyolefins

Q – When is a Price Increase not a Price Increase?

A – When it’s an Energy Surcharge…

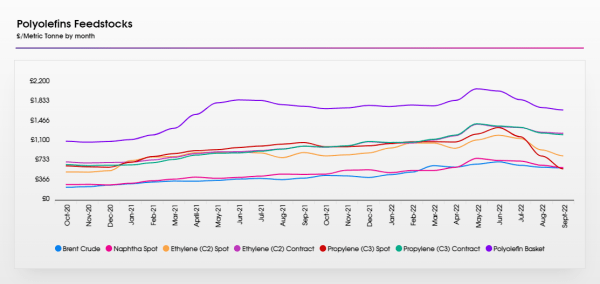

October saw the recent falls in Polyolefin prices halted despite a further drop in monomers. C3 Propylene fell €50 / MT and C2 Ethylene fell €45 / MT. Whilst demand remained muted, supply was sufficiently restricted to at least achieve a rollover to a small increase for many sellers in the market. Many of the major producers proposed the much-discussed Energy Surcharges whilst others sought more standard price increases citing rising production costs.

Increases approaching €200 were asked at the start of the month but eventually, the market settled between rollover and +€50 / MT depending on the grade and the starting point. With the weaker £, UK buyers faced increases regardless of the movement in € pricing. Some grades started to see a little tightness in availability, especially those more reliant on imports into Europe such as LLDPE C4 and HDPE.

Outlook for November is generally considered to be relative stability but with many unknown factors. Oil pricing could rise with the cuts to production leading to Naphtha pricing recovering and affecting monomer pricing. Imports to Europe are mixed with some low offers reported but with limited volumes. If planned rail strikes go ahead in the USA, this will impact the ability to send cargoes to Europe.

For now, many producers are happy to see the decreases stop. Whether or not they can continue to push through the proposed Energy Surcharges in the coming months remains to be seen. If demand remains weak, pricing will probably bobble around the current levels. There are rumours that producers will limit production to start 2023 in a stronger position to push through the increases they want to restore profitability.

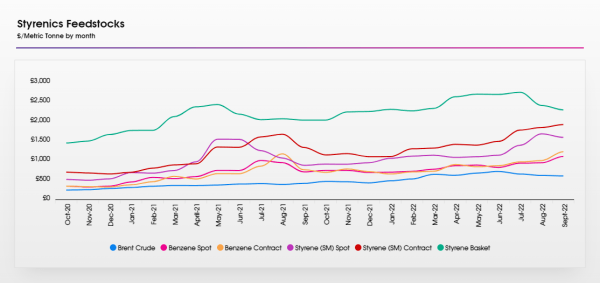

Styrenics

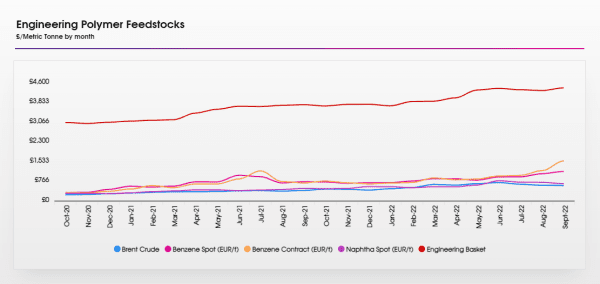

Engineering Polymer Feedstocks

Price Know-How: October 2022 Full Report

Visit the Price Know-How website to read the October 2022 update, including an in-depth analysis of each market segment and material group by Plastributions expert product managers.

Subscribe and keep in the know

Price Know-How is an industry-leading report to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at the leading polymer distributor, Plastribution, with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions, so you don’t need to!

Plastribution

+44 (0) 1530 560560

Website

Email