Polymer Price Reports Released for July 2019

The latest polymer price reports and charts have been released by Plastrack.

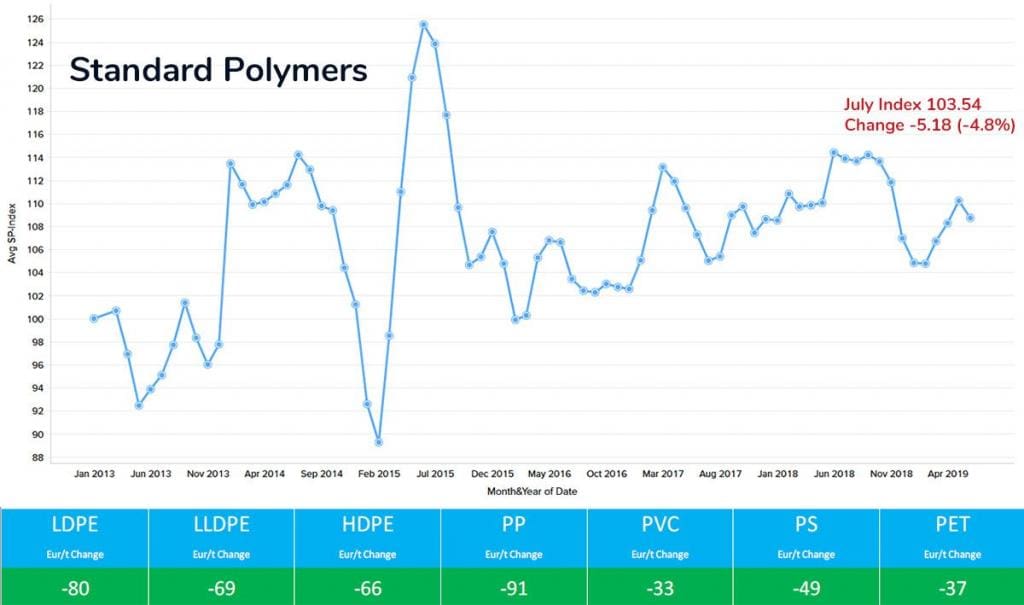

Standard Thermoplastics Trends July 2019:

Ethylene (C2) Feedstock – in July prices were largely stable (a slight increase of Eur 4/mt was seen). The market is well balanced with both supply and demand at normal levels.

Propylene (C3) – In July, prices were stable. The market is currently over supplied with normal levels of supply but low levels of demand.

LDPE, LLDPE, HDPE – significant price reductions were seen during the month of July triggered by a fall in ethylene monomer pricing levels. Supply and demand are at normal levels. Predictions are for price stability in the coming period with lower predicted demand levels attributed to the August holiday period and no major disruption expected from scheduled plant outages for maintenance.

PP pricing reduced by Eur 91/mt in the month of July. Weak demand and a fall in the propylene monomer price level resulted in producers having little choice but to pass reductions through to customers. Demand and supply are at normal levels. There is an expectation that prices will rise in the coming period with stronger pricing for propylene monomer being seen at the current time.

PVC pricing reduced by Eur 33/mt in the month of July. The downward movement was triggered by lower ethylene pricing levels and much lower demand levels due to the holiday period. No major pricing movement is expected in the coming period with continuing weaker than normal demand levels being seen at the present time.

Styrenic prices decreased by Eur 49/mt in the period. Producers were left with no choice than to pass on the styrene monomer price reduction due to much lower demand attributed to the holiday period. Prices are predicted to rise in the coming period.

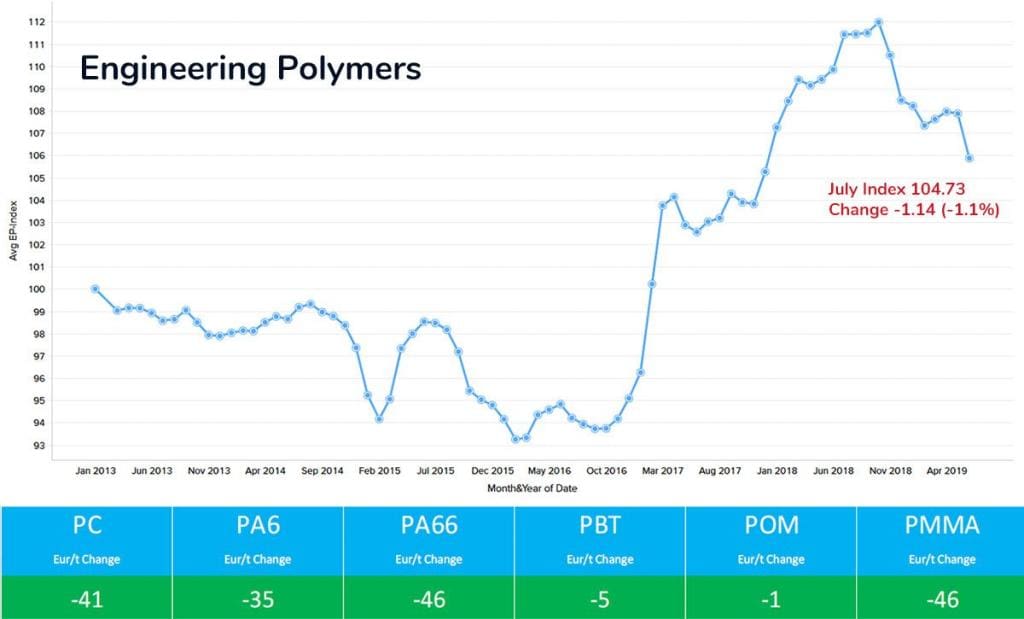

Engineering Thermoplastics Trends July 2019:

Benzene feedstock pricing increased by Eur 39/mt in the month of July. The market remains undersupplied with capacity being limited due to extremely hot temperatures across Europe.

PC prices reduced by Eur 41/mt in the period on the back of high levels of supply and low demand (particularly from the automotive sector which continues to be a headache). Further price decreases are expected in the coming period.

PA6 pricing fell by Eur 35/mt in the month of July linked to supply and demand. Supply remains at a high level, but demand continues at low levels. Price stability is expected in the coming period.

PA66 pricing fell by Eur 46/mt in the month of July. Supply remains at a high level, but demand continues at low levels (particularly from the automotive market). Further price reductions are expected.

PBT pricing was largely stable in the month of July. Supply and demand are balanced and at normal levels. Hints of some significant downward price movements are still being talked about in the market.

POM pricing was largely stable in the month of July. Supply and demand are at normal levels. Predictions are of price decreases in the coming period helped by much lower levels of demand against the backdrop of normal levels of supply.

PMMA pricing fell by Eur 46/mt in the month of July. Supply is at high levels with demand continuing to be low. Further price decreases are expected in the coming period with no signs of demand improvement (particularly from automotive markets), and no change predicted for supply levels.

Plastrack Polymer Price Index

Plastrack is a web-based tool which can be accessed by desktop, tablet, or mobile and provides pricing data on the most common feedstocks and polymers. Prices are updated on a monthly basis based on information obtained by Plastrack researchers directly from plastics producers, traders, distributors, and converters. Visit Plastrack’s website for more information.