Polymer Price Reports Released for June 2019

The latest polymer price reports and charts have been released by Plastrack.

Standard Thermoplastics Trends June 2019:

Ethylene (C2) Feedstock – in June prices reduced by Eur 70/mt due to lower Naphtha price levels and increases in supply following the re-start of production after maintenance outages. The market is balanced.

Propylene (C3) – In June prices reduced by Eur 81/mt following the significant fall in Naphtha price levels and new capacity in Eastern Europe coming on stream. The market is balanced.

LDPE, LLDPE, HDPE – minor price falls were seen during the month of June however the forward prediction is for lower pricing in the coming period due to the significant reduction in price of Ethylene C2 feedstocks. Supply is at normal levels; however demand is subdued (largely due to purchasers holding off placing orders expecting price reductions in coming periods).

PP pricing decreased slightly in the month of June. The market is balanced however, with much lower levels of supply and demand. Supply was affected by maintenance outages, and demand was lower due to holiday plant shutdowns. There was also a restriction in forward ordering from buyers on the basis of an expectation of falling future prices based on the significant falls experienced with propylene monomer.

PVC pricing was largely stable in the month of June. The market continues to be well balanced with demand and supply at normal levels. Lower pricing levels are predicted in the coming period

Styrenic prices decreased significantly (by Eur 138/mt) in the period. This reduction coming on the back of significant decreases in the price of styrene monomer of late. Supply is at normal levels, but demand is much lower than expected. Further decreases are predicted in the coming period.

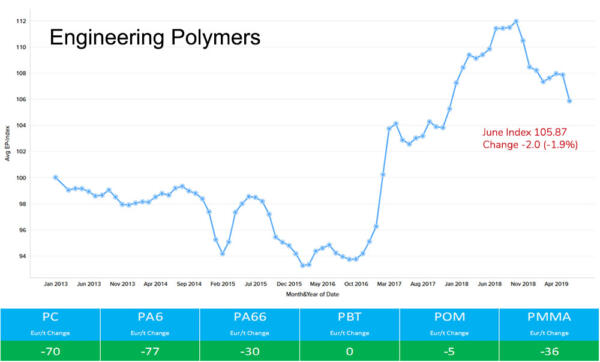

Engineering Thermoplastics Trends June 2019:

Benzene feedstock pricing increased by Eur 32/mt in the month of June as the market experiences an imbalance of supply and demand. Supply is low and restricted due to maintenance outages. Demand continues at normal levels.

PC prices reduced by Eur 70/mt in the period on the back of high levels of supply and low demand (particularly from the automotive sector which continues to be a headache). Further price decreases are expected in the coming period.

PA6 pricing fell by Eur 70/mt in the month of June linked to supply and demand. Supply remains at a high level but demand continues at low levels. Further price decreases are expected in the coming period.

PA66 pricing fell by Eur 30/mt in the month of June. Supply remains at a high level but demand continues at low levels. Significant price reductions are expected in the coming period.

PBT pricing was largely stable in the month of June. Supply and demand are balanced and at normal levels. Hints of some significant downward price movements are coming to our attention for the coming period.

POM pricing was largely stable in the month of June. Supply and demand are at lower levels. Maintenance shutdowns and the holiday season are affecting supply and demand continues to be affected by lower levels of automotive activity.

PMMA pricing fell by Eur 36/mt in the month of June largely due to weakening demand set against a backdrop of normal supply levels and higher levels of imports.

Plastrack Polymer Price Index

Plastrack is a web based tool which can be accessed by desktop, tablet or mobile and provides pricing data on the most common feedstocks and polymers. Prices are updated on a monthly basis based on information obtained by Plastrack researchers directly from plastics producers, traders, distributors and converters. Visit Plastrack’s website for more information.